However there is one central difference in how they do this. Staking cryptocurrencies is a process that involves committing your crypto assets to support a blockchain network and confirm transactions.

Staking Program Earnings Stakes Cryptocurrency

With staking you usually buy a cryptocurrency in order to lock it up stake it in a smart contract.

What is staking on crypto. In simple terms staking coins is the act of locking your cryptocurrency to earn interest. Staking requires using a different protocol called the proof-of-stake PoS model where participants put their coins at stake for the chance to confirm new transactions add new blocks to the blockchain and earn newly-minted coins. Staking is very similar to mining.

Traders stake their crypto assets for a variety of uses. Many long-term crypto holders look at staking as a way of making their assets work for them by generating rewards rather than collecting dust in their crypto wallets. Once your stake is locked up you vote to approve transactions in many cases you dont actually have to vote – it happens automatically.

Yield farming VS Staking. Market Volatility The market volatility of crypto assets is an apparent inherent risk that makes investors lose on their investment. Staking is a core element of many of the worlds most popular cryptocurrencies.

What are the risks of staking crypto. It helps the network reach consensus and rewards users who take part in it. If you stake a crypto coin with an annual interest rate of 10.

Purchase cryptographic money that utilizations confirmation of stake. Essentially users lock up a portion of their crypto for a period of time to support the blockchain and earn crypto. Crypto staking has gained much popularity in recent times as it is beneficial for both the network and the token holder.

Crypto staking is a system used to validate proof-of-stake PoS blockchain transactions. The agreement between the staker and the blockchain network is actually pretty simple. Some of the risks of staking include.

However if one plans to trade in tokens in the short term one must not opt for Staking. By staking some of your funds you make the blockchain more resistant to attacks and strengthen. The concept of staking is closely related to the Proof of Stake PoS mechanism.

The cryptos are being locked in their wallets by the stakeholders. Crypto staking is the process of locking up your cryptocurrency for a period of time to earn interest or rewards on these holdings. Staking has the added benefit of contributing to the security and efficiency of the blockchain projects you support.

The difference is that mining uses a proof-of-work mechanism to verify transactions while staking uses a proof-of-stake mechanism. One can stake assets to support a blockchain networks transactions provide liquidity generate passive income or perform other functions. You may wonder why staking in crypto is called staking.

Earn Passive Income Staking Crypto. The yields being offered are pretty attractive too. Put simply staking crypto begins with a crypto holder committing their assets to a blockchain network to verify the transactions that occur.

Its available with cryptocurrencies that use the proof. Today we will go over the staking crypto meaning. This is the way to stake crypto bit by bit.

If you withdraw your money early you might face a penalty. Cryptocurrencies based on PoS consensus protocols allow participants to earn additional coins by locking up assets in the network as a form of collateral. This is because when you tie your money into the staking process you do not automatically get to add the new block to the blockchain and receive rewards.

Users with the highest number of native tokens are more likely to take on. When tokens are staked it helps to validate transactions on their network while also rewarding token holders and these holders earn interest andor rewards for staking these tokens. Staking cryptocurrencies involves buying and setting aside cryptocurrencies to earn rewards.

Both mechanisms do verify transactions. Crypto staking was created in response to the concerns around crypto minings PoW model. Understand The Mechanism Behind Staking Crypto.

Staking is a way of making passive income on your cryptocurrency and it is not without some inherent risks. However staking crypto actually focuses on the number of native tokens staked or the stored value as an important factor for selection as a validator for the network. Earn fixed or variable interest by lending crypto in a DeFi market.

Crypto staking usually earns a specified interest rate anything from 3 to 10 depending on how long and how much crypto you own. Staking cryptographic money might appear to be a little confounding the initial time around yet its a basic cycle once you get its hang. Staking is considered to be a new way that aids in confirming the transactions.

This process is similar to crypto mining. Theres a good chance you were introduced to staking because you heard about generous rewards that far exceed standard interest rates. Staking is a process that includes delegating your crypto assets to support a blockchain network and check transactions.

You deposit coins for a fixed period of time to earn interest. But staking isnt just about generating rewards. What is Staking Crypto.

Also each exchange and platform will have different rules for different coins most require a minimum staking investment to receive rewards. Staking generally refers to the holding of your cryptocurrency funds in a wallet and hence supporting the functionality of a blockchain system. The primary benefit of staking is earning passive income on your crypto.

This process of confirming transactions occurs only in the cryptocurrencies that use the proof-of-stake model. The blockchain platform motivates stakers by rewarding them with digital tokens based on how many coins they have locked up. Both are used to verify transactions.

Hidden Gems Defi Coins Infographic Cryptocurrency Blockchain

Is Staking Cryptocurrency Worth It In 2022 Cryptocurrency Passive Income Best Cryptocurrency

Earn Crypto From Staking On Kucoin Exchange In 2020 Online Earning Earnings Stakes

What Is Staking Staking Rewards Fintech Stakes Fundamental

What Is Staking In Crypto Beginner S Guide For Staking And Proof Of Stake Protocol Stakes Proof Beginners

Icb Crypto Services Staking Yield Farming Liquidity Mining In 2022 Stakes Farm Beauty

Ethereum 2 0 Staking Explained Cointelegraph Cryptocurrency Blockchain Red Zone

These Are The Best Cryptocurrencies For Staking In 2022 Blockchain All About Time Digital Wallet

Is Staking Cryptocurrency Worth It In 2022 Cryptocurrency Data Science Spending Problem

What Cryptocurrencies Have The Best Staking Rewards Earn Cryptocurrency Coin Market Investing

What Is Staking In Cryptocurrency A Beginner Guide Coinexpansion Blog And Podcast A Crypto Platform Cryptocurrency Beginners Guide Stakes

Proof Of Work Crypto Staking In 2022 New Crypto Coins Blockchain Technology Cryptocurrency

What Is Staking In Crypto Definition Rewards Risks In 2022 Stakes Definitions Rewards

Proof Of Stake Blockchain Stakes Cryptocurrency

Pin On Vidulum App Multi Asset Crypto Wallet

What Is Staking Crypto Easy Way To Earn Rewards By Holding Your Funds Stakes Earn Rewards Earnings

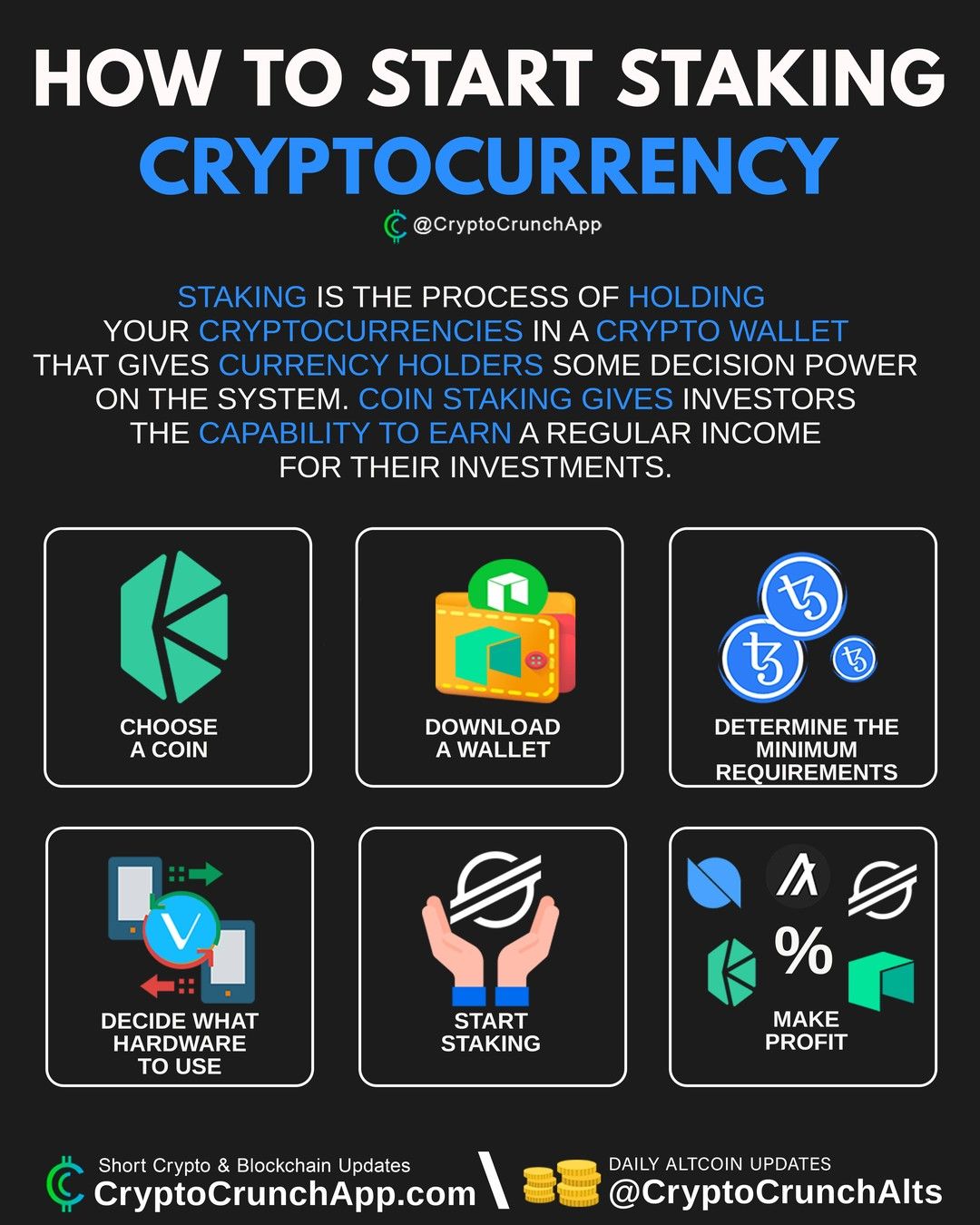

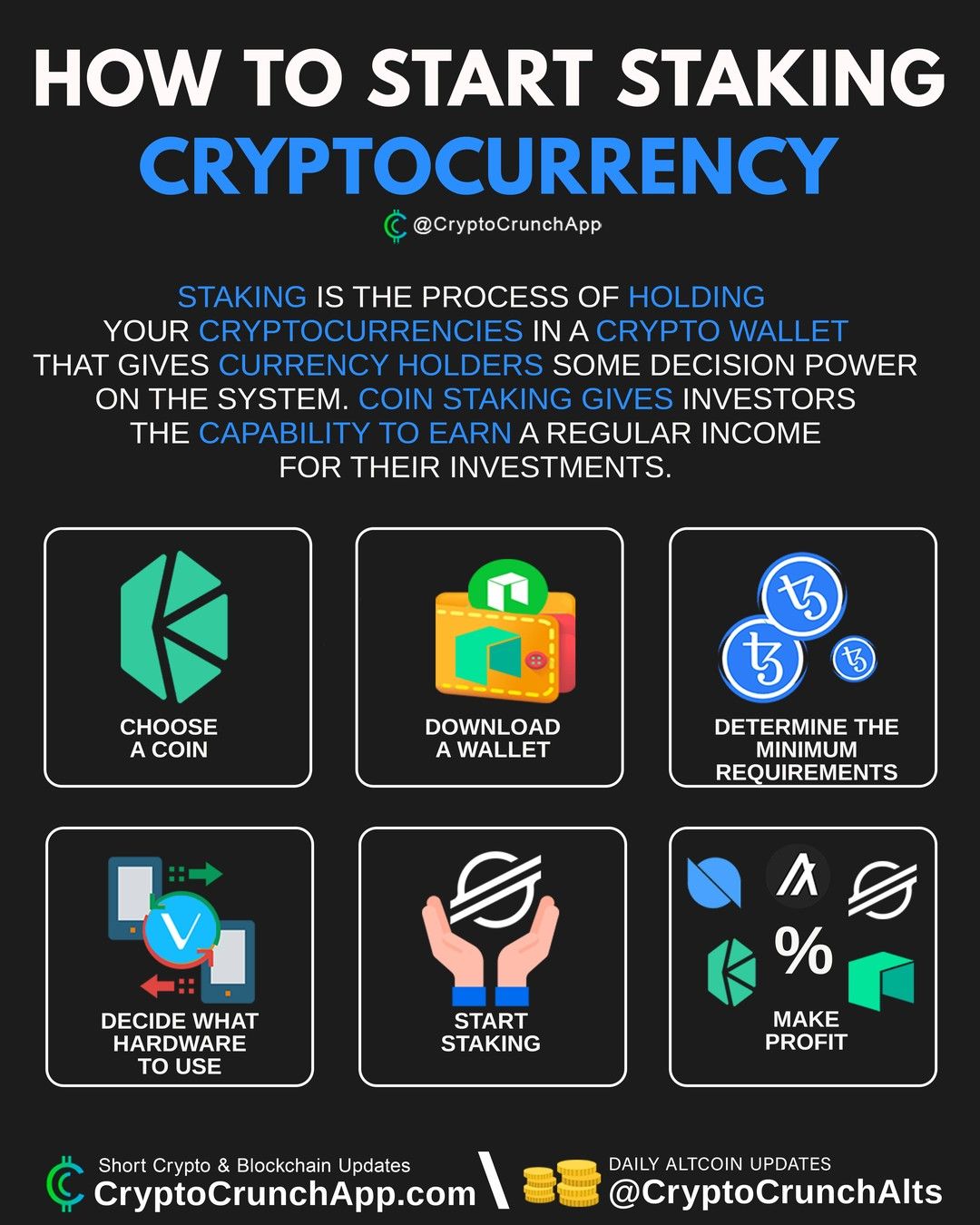

How To Start Staking Cryptocurrency Follow Cryptocrunchalts Follow Cryptocrunchalts Follow Cryptocrunchalts Foll Cryptocurrency Bitcoin Power