How to file crypto taxes. Robinhood Crypto Taxes Explained.

Bitcoin Wiki Patriot Coin Cryptocurrency Taxes On Cryptocurrency Reddit Bitcoin Buy Lamborghini Bitcoin Diamond Ledger Cryptocurrency Bitcoin Currency Bitcoin

Log In Sign Up.

Robinhood crypto and taxes. Crypto Taxes on Robinhood. Users looking to switch to another service should time their moves says CPA Shehan Chandrasekera of CoinTracker. They have managed to create a reliable.

Robinhood does not provide tax advice and you should consult a tax professional regarding any specific questions you have regarding taxes owed in connection with cryptocurrency transactions. That means its taxed in much the same way as stock. A 1099 shape indicates our tax records the quantity of cash you obtained at some point of the 12 months from selling securities and the quantity of found out losses that.

I have all kinds of transaction. Every time you sell a stock ETF or cryptocurrency you will incur what the IRS considers a taxable event. Since the 1099-B for robinhood crypto isnt reported to IRS – do I need to report every single trade or is total proceedscosts basis fine.

It can be that an updated form is sent to you. Some beginners think you only get taxed for when you withdraw the money from your Robinhood account to your bank. Currently Robinhood lets in users to download a complete shape 1099-B showing investors their complete capital gains and losses for the.

Qualified dividends are certain dividends from US companies that qualify to be taxed at the long-term capital gains rate. Posted by 3 years ago. Generally per IRS guidelines virtual currency is treated as property and general tax principles applicable to property transactions apply to transactions using virtual currency.

To upload a Robinhood crypto 1099 form to TurboTax go to the Wages and Income screen and select Cryptocurrency. In TurboTax go to the Wages. Whenever you make a stock sale you might owe taxes on that transaction.

Does Robinhood provide a tax report. It is vital that the correct Robinhood tax info is recorded in line with these updated 1099 forms. Depending on how long youve held the crypto this event will be regarded as a long or short-term capital gain or loss and will count towards your net capital gains for the year.

Taxpayers will have to deal with the question of whether or not they owe taxes on cryptocurrency pretty immediately when filing. Grandpa Biden needs those tax dollars if he keeps printing money at this rate. 5 of money cashed out.

You can find this under Tax Documents within your Robinhood account. Ordinary dividends are taxed at your ordinary-income tax rate. If you received a Robinhood Crypto 1099 Robinhood will also provide a CSV file with your cryptocurrency transactions.

Robinhood Crypto and Taxes. Address the crypto question on Form 1040. Connecting your Robinhood account to CoinTracker To add your Robinhood transactions download the CSV export of your transactions and import it.

Whenever you exchange your crypto for fiat currency it will be considered a taxable event. Lets go through the why what and how of Robinhood and understand how do you pay taxes on Robinhood stocks as well. While Robinhoods app may glitter its lack of automated tax-saving options may cause you to lose out on a lot of gold.

You also have to meet a minimum holding period. Cashing out can trigger capital gains taxes. If you mix Robinhood crypto trades with other crypto trades one problem you need to deal with is the crypto tax report you generate by using a crypto tax software will not provide the breakdown between Box A and Box C.

Answer Yes when asked if you traded. Robinhood trading app allows investors to buy crypto but they cant transfer it out. When asked Did you sell or trade cryptocurrency in 2021 click Yes.

CoinTracker integrates directly with Robinhood to make tracking your balances transactions and crypto taxes easy. Robinhood Crypto Taxes Explained. Also basis and probably sales proceeds as well for your Robinhood trades in the aggregated tax report will not match the Robinhood 1099-B.

I just worked on this one individuals crypto tax reporting and its so tedious to do. The IRS considers cryptocurrency property for the purpose of federal income taxes. You should be reporting gains or losses whenever you either cash out or exchange one coin for another.

You can use this to declare your Robinhood crypto taxes separately. With Robinhood you can earn both ordinary and qualified dividends. Robinhood Crypto and Taxes.

Is Robinhood secure when it comes to producing and recording tax information. One such brokerage is Robinhood that exclusively gives you access to Robinhood tax documents which will help you file and report your taxes. Robinhoods halting of trading of certain stocks has many users reconsidering whether its the right platform to hold their cryptocurrency.

Just saw a bit on the Treasury dept noting the US govt is leaving 700 billion on the table this decade through loose tax laws on crypto. This is a terrible mistake that can come back to bite you. For now however the IRS is treating crypto as property rather than cash.

Log in or sign up to leave a comment. Upload your CSV file. Taxes On Dividends.

Guidelines are found in IRS Notice 2014-21 IRB 2014-16. Ranging from 10 to 10000. Cryptocurrency is a relatively new development and as such the IRS rules about it could change at any time.

Select Robinhood then click Continue. Robinhood Crypto provides users who sold crypto with a Consolidated Form 1099-B. The purchase and subsequent sale of crypto must be recorded on the Robinhood Crypto IRS Form 1099.

There are three main scenarios where you will be taxed on your crypto activity in Robinhood. Now there are a lot of crypto exchanges and brokerages that can help you with your taxes. This tax report includes all your disposals of crypto within the Robinhood platform.

As Robinhood doesnt have a tax API just yet the easiest way to do your crypto taxes is to export a CSV file of your crypto transaction history from Robinhood and import that file into Koinly to calculate your crypto taxes and generate your tax report. Crypto tax laws are going to continue to change so any advice you get might be irrelevant come next April.

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

How Do Robinhood Crypto Taxes Work Koinly

Robinhood Crypto Taxes Explained Cryptotrader Tax

Cryptocurrency Amp Taxes Wealthy Wednesdays In 2022 Cryptocurrency Wealthy Tax

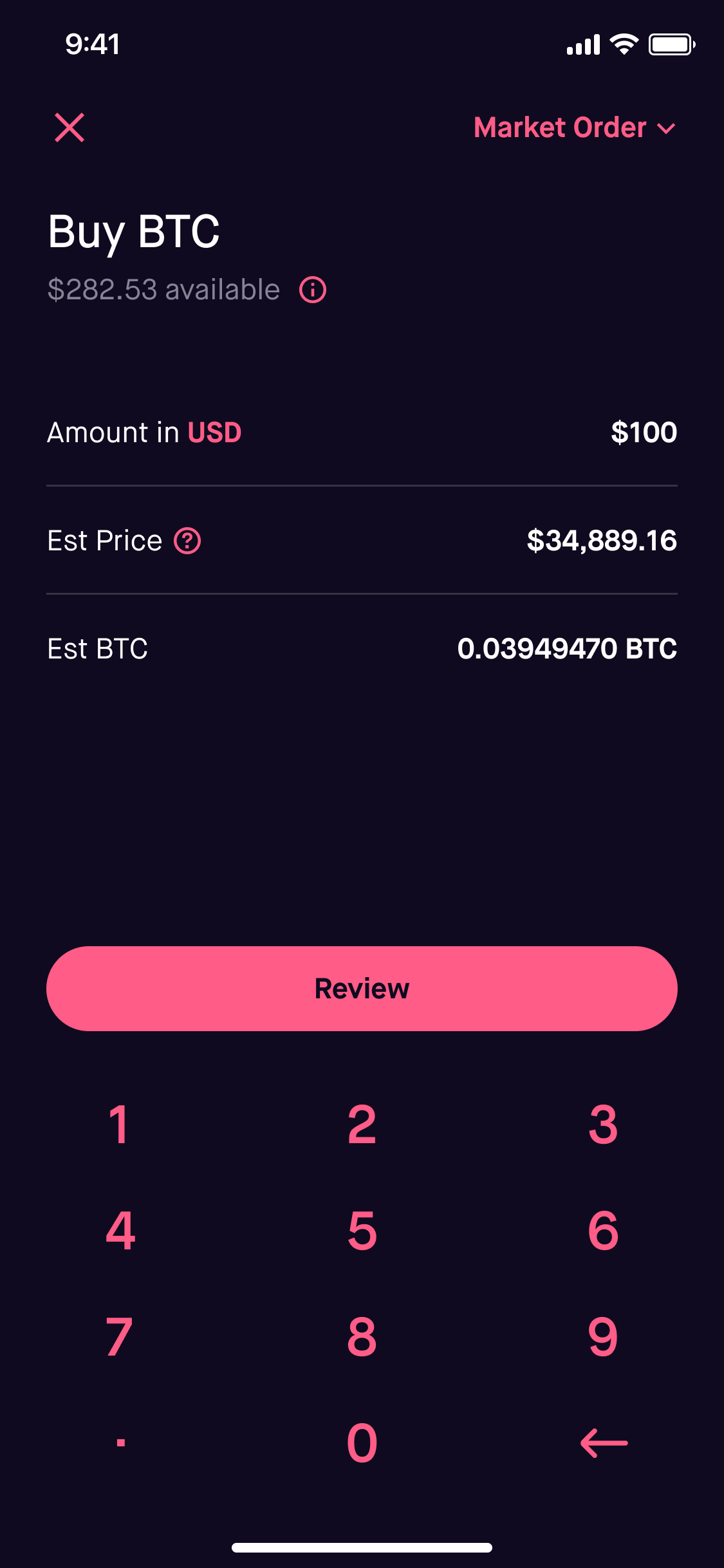

Pin By Tailor Made Startups On Design Cryptocurrency Trading Stock Trading Buy Bitcoin

Pin By Buy The Dip Hodl On Money Banks Cryptocurrency Debt Taxes News Shiba Inu Shiba Inu

Crypto Traders Pay 15 Of Their Profits As Taxes In Thailand Crypto Pay Profits Taxes Thailand Traders In 2022 Capital Appreciation Thailand Capital Gains Tax

Robinhood Begins Rolling Out Crypto Wallets To Select Customers In 2022 Initial Public Offering Robinhood App Financial Services

Pin By Buy The Dip Hodl On Money Banks Cryptocurrency Debt Taxes News Shiba Shiba Inu Inu

Robinhood Discusses Crypto Pockets Launch Itemizing Technique As Petition To Checklist Shiba Shiba Shiba Inu Inu

Cryptocurrency Investing Robinhood

Message Or Email Me For More Information And Let S Start Saving Tjones Sweeneyconrad Com How To Plan Bitcoin Let It Be

How To Report Robinhood Crypto Transactions Crypto Tax Advisors

Crypto Copy Trading Platform Simple And Transparent In 2022 Trading Simple Transparent

Pin By Buy The Dip Hodl On Money Banks Cryptocurrency Debt Taxes News Shiba Inu Shiba List

How To Read Your 1099 Robinhood

The 7 Best Stock Trading Apps Of 2020 Stock Trading Free Stock Trading Best Stocks

Watch Before Monday Huge Bitcoin News Crypto Price Analysis Ta Amp Btc Cryptocurrenc In 2022 Best Crypto Analysis Bitcoin

Pin By Coinspeaker On Bitcoin News Security Token Blockchain How To Raise Money