Robinhood works differently than most crypto exchanges – so youve got a couple of options for reporting your Robinhood taxes. In the past cryptocurrency exchanges have not been required to report any information about gains or losses to the IRS or to their customers.

Where Do I Find The Document Id Number On My Robin

A quick Google search showed I needed Premier so I paid 30 to upgrade from Deluxe to Premier and I still do not see where I can upload this CSV.

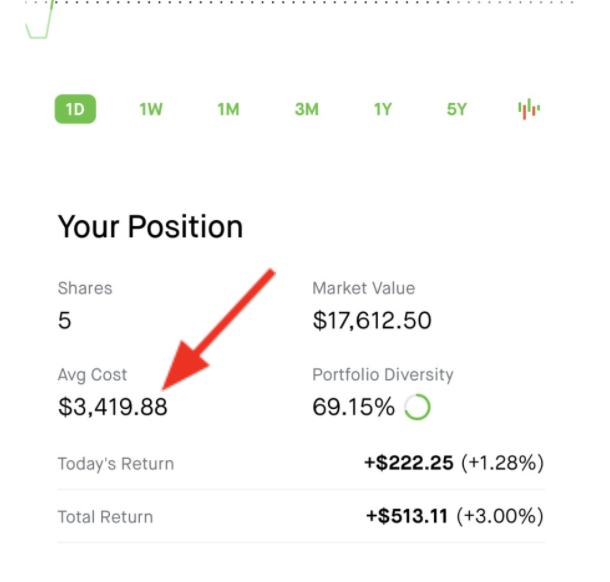

Robinhood crypto tax reporting. In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return. This form reports interest income earned from your investments. 5 of money cashed out.

Normally 1099-B forms dont work for crypto exchanges as theyre unable to track the cost basis and. Does trust wallet report to IRS. Some crypto investors are wondering if they could aggregate crypto trades in their Robinhood account with their crypto transactions in other exchanges and wallets when doing the overall crypto tax calculation.

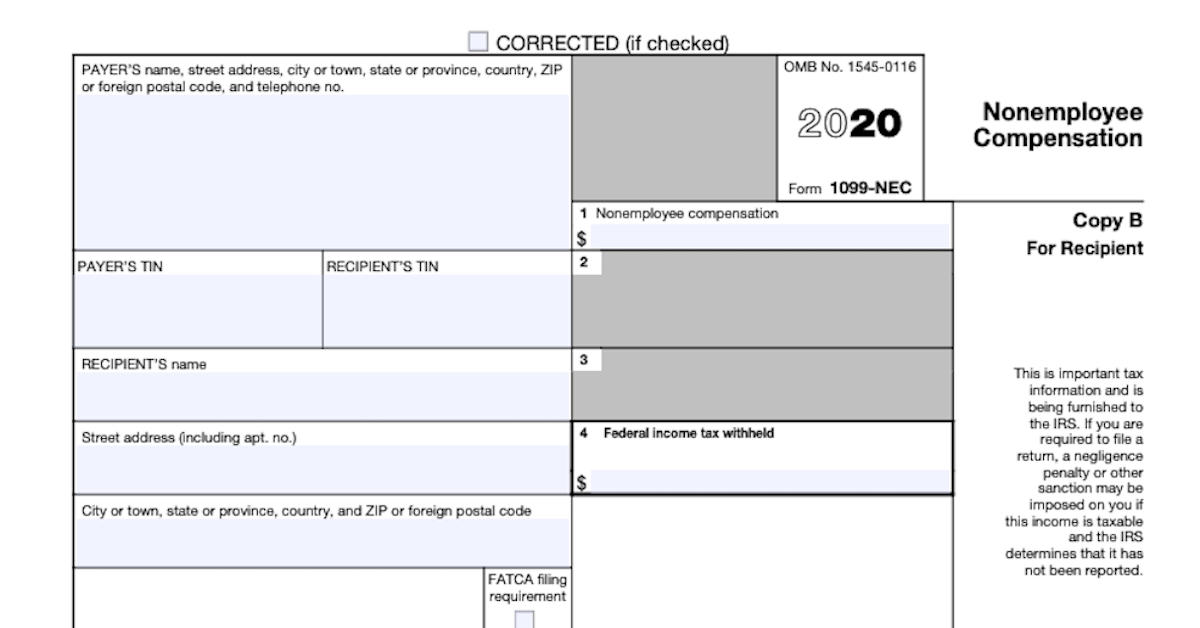

When Robinhood sends the 1099 forms. If you sold crypto or received rewards of 600 or more in 2021 you will receive a Consolidated Form 1099 from Robinhood Crypto LLC this tax season. So the 2021 tax forms will be available Mid-February 2022.

Youll not only get the PDF format of the form but also a CSV format that can easily be imported into tax reporting software like ZenLedger. Easy Way To Do Taxes with Robinhood App 2019 Turbo Tax You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base. Tax reports generated by this platform are based on your historical data and can be provided to your tax professional or.

If you dont report income on your tax return from the platform that filed a 1099 on your behalf. If you need any amendments made due to any transactional errors you can submit a review request and Robinhood will look into it to make sure you are reporting correctly. Robinhood usually sends all 1099 forms you may need in mid-February.

This form reports your capital gains or losses from your investments. New Crypto Tax Reporting Requirements in the 2021 Infrastructure Bill. Tax Forms Robinhood Will Provide.

No matter if you are a day trader or long term investor filing your Robinhood 1099 taxes is simple but only with the proper guidance. That year I really didnt file any securities related stuff so I guess thats a 0 for my reported capital gains. I just worked on this one individuals crypto tax reporting and its so tedious to do.

Calculate your taxes and generate all required tax reports and forms easily. So if youre reporting crypto transactions for multiple platforms Koinly makes it simple. Capital assets subject to this tax according to the Canada Revenue Agency include buildings land shares bonds and trust units.

Youll receive a Robinhood Crypto IRS Form 1099 if you sold more than 10 in cryptocurrencies in 2020. Coinpanda has direct integration with Robinhood to simplify tracking your trades and tax reporting. Trust Wallet Tax Reporting You can generate your gains losses and income tax reports from your Trust Wallet investing activity by connecting your account with CryptoTrader.

When you sell virtual currency you must recognize any capital gain or loss on the sale subject to any limitations on the deductibility of capital losses. All tax documents will be available in Mid-February for the previous tax year. Also if you need a corrected 1099 it will be available from Robinhood at the end of March.

Ranging from 10 to 10000. Im being asked to pay unreported income on tax year 2019. Robinhood unreported crypto audit.

Though you can file your Robinhood taxes separately using your Consolidated 1099-B if youre using any other crypto exchanges or wallets these wont be included in your 1099-B form. Crypto Taxes on Robinhood. This makes tax reporting very easy because people can rely on the 1099-B to report crypto gains and losses on their tax return.

How to Report Your Robinhood Taxes. Youre likely to receive the Robinhood Crypto IRS Form 1099 if you had sold your crypto assets anytime in 2020. Starting in tax year 2023 cryptocurrency exchanges will have to report crypto transactions to the IRS via 1099s thanks to the Infrastructure Investment and Jobs Act signed into law last November.

Any help is apprecia. Cryptocurrency is considered a form of property by the IRS and is subject to capital gains tax upon disposal and ordinary income tax when earned. Whether you invest in stocks exchange-traded funds ETFs options or cryptocurrency Robinhood is an excellent platform to invest in your future while on a budget.

You should be reporting gains or losses whenever you either cash out or exchange one coin for another. IRS sent a CP2000 saying robinhood reported 12774 and that discrepancy ends up on taxable income line 11b of the 1040. Preview1 hours in the past Robinhood Crypto IRS Form 1099 For any cryptocurrency interest that took place final 12 months an accompanying PDF and CSV report might be Simply navigate to Robinhood tax report section and down load your 1099.

Section 80603 of the Infrastructure Investment and Jobs Act HR. Koinly is a Robinhood crypto tax calculator and reporting tool. Remember when major exchanges send you a Form 1099 they file an identical copy with the IRS.

I have all kinds of transaction. Can the government see Bitcoin. 2018 Robinhood Crypto 1099 CSV.

You may have multiple forms if you have done transactions through Robinhood Securities and Robinhood Crypto during the year. This makes tax reporting very easy because people can rely on the 1099-B to report crypto gains and losses on their tax returns. Hi – I originally downloaded Turbo Tax Deluxe to do my taxes but I saw it didnt have an option for me to upload a csv for crypto.

3684 clarifies reporting requirements so that taxpayers do not. Paying Taxes on Robinhood Stocks When you receive your consolidated Form 1099 or Robinhood notifies you that you arent due any tax documentation youll have all the information you need to properly file taxes on your Robinhood stocks and cryptocurrency. You can give this document in conjunction with your CryptoTraderTax reviews.

Some crypto investors are wondering if they could aggregate crypto trades in their Robinhood account with their crypto transactions in other exchanges and wallets when doing the overall crypto tax calculation.

How To Download Tax Documents From Robinhood Wealth Quint

Crypto And Taxes The Basics Part 1 By Dorian Kersch Lunafi Blog Medium

Robinhood Crypto Taxes Explained Cryptotrader Tax

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube

How Do You Pay Taxes On Robinhood Stocks

How To File Robinhood 1099 Taxes

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

New Crypto Tax Reporting Requirements In The 2021 Infrastructure Bill

Cryptocurrency Taxes Guide 2022 How Why To Report Your Profits

Does Robinhood Report To Irs Wealth Quint

How Do Robinhood Crypto Taxes Work Koinly

How To Report Robinhood Crypto Transactions Crypto Tax Advisors

Robinhood Taxes Explained 2022 How Are Investment Taxes Handled

When Do Robinhood Tax Documents Come Out Top 5 Tips

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

How To Read Your 1099 Robinhood

United States What Are The Requirements To Not Report All Stock Transactions On The Tax Return 1099 B Personal Finance Money Stack Exchange

How To File Crypto Taxes Robinhood And All Other Brokerage Acct Turbotax 1099b Youtube