What is Ethereum Staking in detail. And for doing all this they receive rewards.

Ethereum 2 0 Staking Eth On Eth2 Figment Building Web 3

With many options out there should you stake Ethereum on Coinbase.

Is staking ethereum safe. This is similar to mining but while the former is based on a proof-of-work system it is based on the proof-of-stake system. Increases the speed of transactions and creates a more secure network. While many regard becoming a validator as the risk-free rate its important to recognize that in practice theres some risk associated with depositing your ETH into the network.

Staking with lido means staking with many validators thus spreading the risk of slashing. Ethereum 20 the new version of this cryptocurrency is expected to arrive in a few months and it will do so with radical changes. Staking ETH permits the staker to act as a validator on Ethereums proof-of-stake Beacon Chain support the Ethereum 20 upgrade and be eligible to earn staking rewards.

Staking is the act of depositing 32 ETH to activate validator software. Your staked coins are safe and there is no chance of losing your stake. EOS is traded across multiple exchanges is a top 10 cryptocurrency by market cap and has been around for a while.

Lido applies a 10 fee on staking rewards split between node operators the DAO and an insurance fund. Its safer than most smart contracts as its being audited by 2 top tier companies. Everyone else has to either assume risk from cefi or defi third parties or just hodl and hope that market gains outpace dilution.

ETH2S cannot be un-staked and neither ETH2S nor ETH2 may be transferred on the Ethereum network at this time. How long will Ethereum staking last. The only Ethereum stakers who are truly safe from hackers are the ones with 32 ETH and can run a validator node.

But slowly it is moving towards the proof-of-staking system as the ETH 20 rolls out. Staking cryptocurrencies is proof of stake PoS protocol. This will keep Ethereum secure for.

When it comes to staking ETH there are a handful of risks that any prospective validator should be aware of. You can use stETH staked ETH to provide liquidity on curvefi in stETH – ETH pool. There is no risk in staking If there is profit there is always risk.

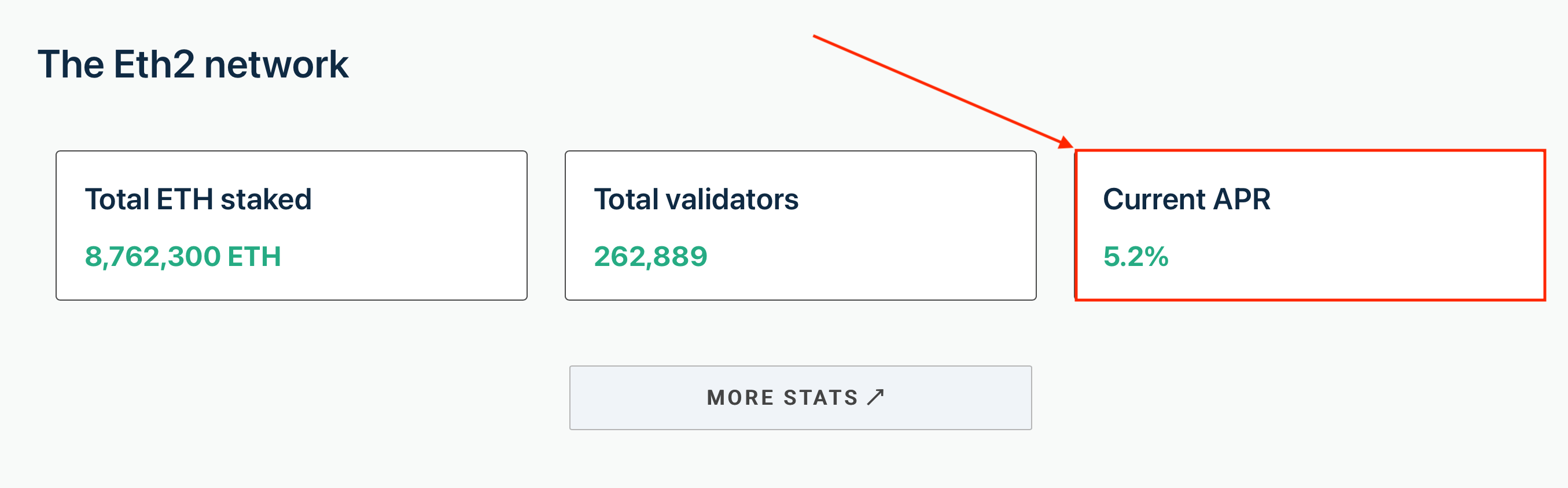

When there is very little ETH staked the protocol rewards will be larger as an incentive for more ETH to come online. The upgrades are primarily distributed into three parts and an essential part of it is. The Ethereum staking reward rate is variable and changes based on the total amount of ETH staked with a maximum annual reward rate of 1810.

This fee can be changed by the DAO pending a successful vote. It reduces running costs. You can stake Ethereum with online exchanges like eToro.

So before staking you must acquire complete knowledge or do not stake it at all. While it is true that staking means that validating transactions and gaining some ETH no longer require as much computing power Ethereum users need to be mindful of the drawbacks. Coinbase will soon offer Ethereum staking with rewards up to 75 interest at the start.

The percentage wont change though unless it actually changes from 8. Staked there for sometime. ETH staking rewards are given in accordance to how much ETH is validated and what rewards the network is offering over a time period.

Drawbacks of staking ethereum. It is not allowed to withdraw your staked ETH with direct Ethereum staking. This method of Ethereum staking not only serves as a passive income opportunity for contributors but it also helps to secure the next.

For example if the staking platform you choose is a scam you will likely lose your money. Aside from general smart contract risk which applies no more to this than to any other smart contract in. However Ethereum staking is far from perfect.

If you have staked your Ethereum and the price rises yes as the value of your stake increases it will increase your rewards. Our strongest advice is to avoid ETH staking if you do not like to lock your funds for an indefinite period of time. You may earn yield on any ETH that you stake as a reward for helping secure the network.

This video will discuss the pros and cons of staking Ethereum on Coinbase and other available options on earning interest with your Ethereum. On the other hand if you choose a reliable and trustworthy platform then theres a high chance that you will earn in the long run. While EOS has its advantages just like any cryptocurrency it suffers severe price fluctuations.

Liquid staking Ethereum is safe in general but there are several factors to consider. I wanted to know is staking your ETH on Rocket Pool safe or is there risk involved. The ability to earn rewards for ETH staking comes with some risks.

With aETHc you can hold or trade your staked assets at any time without having to wait until transactions are. Those changes will probably make us start talking much less about mining and more about staking a reward system that is a 20 version of our old checking accounts when they were decently profitable. October 19 2021 by John Flores.

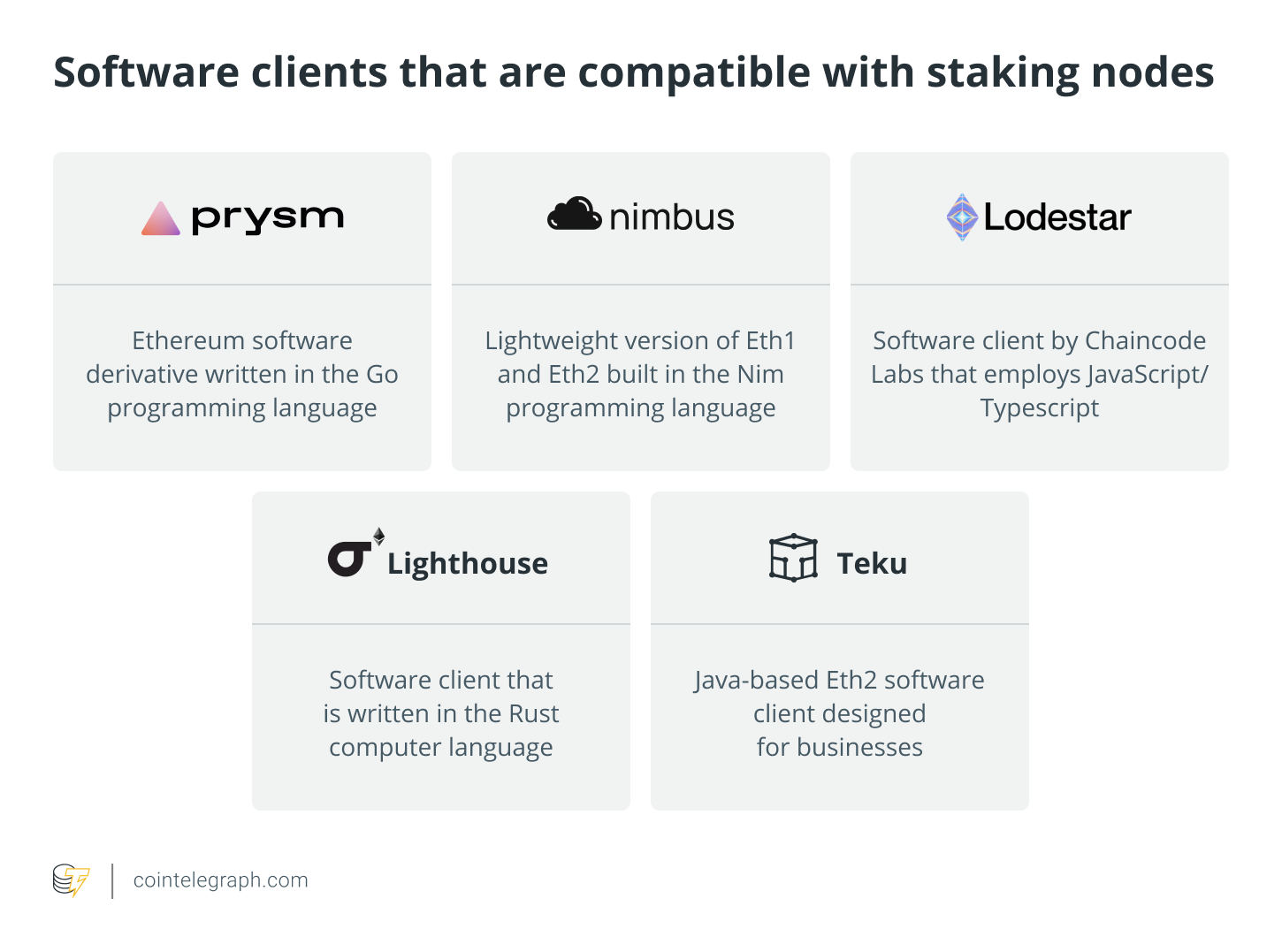

ETH 2 Staking Risks Offline Validators. As a validator youll be responsible for storing data processing transactions and adding new blocks to the blockchain. As with most blockchain networks if you want to stake ethereum.

Further information on this may be found on our blog. Over the past 12 months it hit a low of 155 and a high near 9. Staking it yields a reward around 438.

Send all of your ETH in one transaction and the protocol will automatically allocate your funds to the best pools. Likelihood of happening and impact lost principal lost interest etc. Ethereum is currently based on a proof-of-work system.

Only the nature of the risk varies. As already mentioned above BETH is a good alternative way to hold staked ETH on the Binance platform. Because of the lower hardware requirements PoS is also less damaging to the planet.

Rewards average between 5. However it is essential to keep in mind that these projects also come with high risks. Ethereum is in the midst of a significant upgrade and community participation is mandatory to ensure that the resultant network works for a majority of the potential users.

Staking Ethereum on Coinbase is an easy lucrative way to participate in Ethereums governance. Staking cryptocurrency in general doesnt pose any real risk. Non-risk yield which beat inflation by visible margin does not exist in this world or it would be a money printer and we all would be driving lambos for free.

The primary goal of Ethereum 20 is to make ethereum more scalable sustainable and secure.

Ethereum 2 0 Staking Explained Cryptocurrency Best Cryptocurrency Blockchain

Staking Eth 2 0 Binance Binance Support

How To Stake Ethereum Without Locking It Up Coinmonks

How To Stake 32 Eth The Best Practices Eth2 Staking By Gaurav Agrawal Coinmonks Medium

Staking Eth 2 0 Binance Binance Support

Top 5 Cryptocurrencies For Staking In 2022 Cryptocurrency Stakes Development

Ethereum 2 0 Staking A Beginner S Guide On How To Stake Eth

Staking Eth 2 0 Binance Binance Support

Ethereum 2 0 Staking Rates Earn Eth Interest By Staking

Ethereum Proof Of Work Mining Vs Proof Of Stake Staking Profitability Comparison Crypto Mining Blog

Advantages Of Staking Link On Linkpool Buy Cryptocurrency Stakes Cryptocurrency

Eth 2 0 Staking Now Live In Argent

Earn Passive Income Every Day By Staking Ethereum Online Forex Trading Online Trading Passive Income

Ethereum 2 0 Staking Upgrade Can Trigger Eth Price Rally Bitcoin Price Cryptocurrency Bull Run

How To Earn Interest With Staking Ethereum Eth Bitcoin Ira

Ethereum 2 0 Staking A Beginner S Guide On How To Stake Eth

Ethereum 2 0 Staking Rewards Are Coming Soon To Coinbase By Coinbase The Coinbase Blog

Staking Eth 2 0 Is It That Easy Ethereum Beth Pool Rewards Back Binance Farming Yield Passive Income Duration General Knowledge