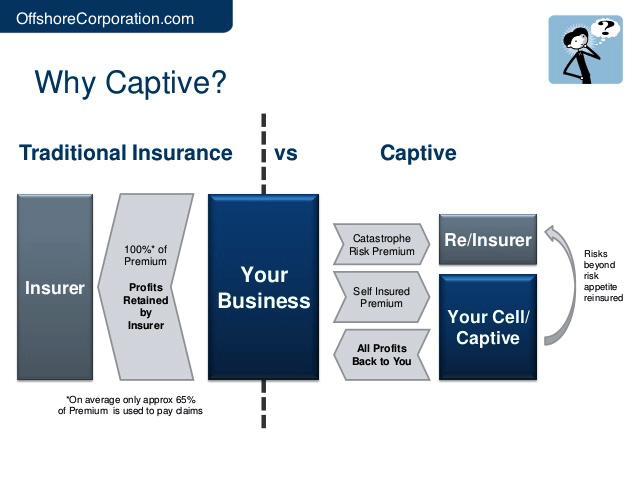

A captive insurance company is a wholly-owned subsidiary insurer that provides risk-mitigation services for its parent company or a group of related companies. Largest MGAsunderwriting managersLloyds coverholders.

Captive Insurance Company Formation Irs Requirements

Request a free trial today.

List of captive insurance companies in the us. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds. Find their contacts along with other data. The term captive insurance was coined by Frederic Reiss a property-protection engineer in Youngstown OH in 1955.

Largest US-based surplus lines insurers. Thursday March 31 2022. Many businesses begin with coverages such as the deductible or self-insured portions of general liability auto casualty property and workers compensation losses but often expand coverages to include unique risks such as.

COVID-19 has highlighted some of the potential commercial benefits of using captive insurance and reinsurance arrangements and the important role captive insurance companies can play as a risk mitigation tool. The firm provides audit and accounting services to a wide range of clients from captive insurance companies insurance managers and mutual funds to local corporations. An introduction and background to captives A captive insurance company is an insurance company that is established to predominately insure or reinsure the risks of its parent or organisations affiliated with its parents.

Captive insurance companies have been in existence for over 100 years. Captives have existed in some form since the 1870s when the first protection and indemnity clubs were created. Explore how the PitchBook company database can help you create detailed company lists.

Ad Get a comprehensive list of companies youre interested in. For example some captives are paying out claims on risks groups are exposed to such as contingency. Largest cyber security insurers stand-alone policies.

Reiss established the first captive insurance company in Bermuda in 1962. This category includes the top and most popular USA insurance companies that offer a wide range of insurance types and financial services such as car auto insurance life health accident insurance retirement and savings personal property and casualty insurance annuities mutual funds and moreThe most of them operate in other countries all over the World. The table on page 4.

The first active captive insurance company in the united states was started in ohio by fred reiss who in 1953 founded steel insurance company of america for youngstown sheet tube company in ohio. Captivesa special type of insurer set up by a company to insure its own risksfirst emerged in the 1980s. Captive insurance companies of non-insurance groups key transfer pricing considerations 05 It remains to be seen how tax authorities will interpret and apply the new rules in practice.

List of Licensed Captives as of March 4 2021. That is whether they treat each of the six criteria listed above as absolutely required to delineate the transaction as one of insurance. These points do not clearly distinguish the captive insurer from a mutual insurance company.

In 2000 less than half of the Fortune 500 and SP 500 companies had captives. The main purpose of doing so is to avoid using traditional commercial insurance companies which have volatile pricing and may not meet the specific needs of the company. The captive domicile is the state territory or country where a captive insurance company is located that also licenses the insurance company and has primary regulatory oversight.

With 620 licensed captives Vermont was the largest US. Captive insurance companies are normally formed to supplement commercial insurance allowing companies to retain the money that would otherwise be spent on insurance premiums. Over the past 30 years there has been significant growth in the captive market.

A captive insurance company may be. Identify top industry players. Large companies often use captives to lower their insurance costs sometimes in offshore tax-advantaged locations.

Below is a list of the top domiciles for captives both. A captive is a licensed insurance company utilized to insure a wide range of risks depending on business needs. Some industry sources believe 50 percent of the property casualty insurance written in the US today is through captives.

Its primary purpose is to insure the risks of its owners and its insureds benefit from the captive insurers underwriting profits. By expanding the captive solutions to a broader group of clients which allows inclusion of companies whose budgeted premium is only 100000 or greater Management Services International MSI allows for more captive owners to enjoy the benefits of a captive insurance appropriate when appropriate for their business. The insurance industry is broken and successful business people should take advantage of the federal laws that allow them to escape the hard and soft market cycles of traditional insurance and start their own insurance companies.

1050 First Street NE 801 Washington DC 20002 Phone. Today 90 percent of them do. Captive domicile in 2021 based on data in an annual survey of the worlds largest captive domiciles conducted by Business Insurance magazine.

Discover a complete list of Singapore companies in captive insurance. You may have heard about captive insurance before but most people I have met do not have a firm understanding of exactly what they are who. The first active captive insurance company in the United States was started in Ohio by Fred Reiss who in 1953 founded Steel Insurance Company of America for Youngstown.

Grant Thornton Cayman Islands has been established in Grand Cayman since 1978 and has expanded to become the islands fast growing firm with over 40 employees in 2019. List Of Captive Insurance CompaniesAny insured who purchases captive insurance must be willing and able to invest its own resources. Captive insurance is an alternative to self-insurance in which a parent group or groups create a licensed insurance company to provide coverage for itself.

The Cayman Islands captive insurance industry is composed mainly of companies insuring risks in North America 90. Directory of Vermont Captive Insurance Companies by License as of 3312022. A list of insurance business classes along with the related gross premiums total assets and total licenses issued are available in.

Compensation the second largest with 21 companies.

![]()

Share Of Captives Worldwide Business Insurance

Key Factors To Consider When Establishing A Captive Insurance Company Ocorian

Captive Insurance Companies Valuescope The Valuation Experts

Captive Insurance Industry Company Service Providers Directory

The Benefits Of Captive Insurance Companies

![]()

Largest Captive Managers Business Insurance

Captive Insurance Industry Company Service Providers Directory

Captive Insurance Company Benefits Chamberlin Financial Inc

Largest Captive Managers Business Insurance

Captive Insurance Industry Company Service Providers Directory

Captive Insurance Times Domicile Guidebook 2020 Vol 4 By Captive Insurance Times Issuu

Life Insurance Companies In Canada Full 2020 List

Key Factors To Consider When Establishing A Captive Insurance Company Ocorian

Captive Insurance Companies Valuescope The Valuation Experts

Retention Series How Are Captive Insurance Premiums Determined Helping Professional Service Firms Make Appropriate Funding Decisions For Their Captives Aon Professional Services

Captive Insurance Companies Valuescope The Valuation Experts

Infographic A Quick Guide To Captive Insurance Risk Management Tax Planning Infographic Quick Guide Management

Key Benefits Of Establishing A Captive Insurance Company Ocorian