Drag your formatted Transaction History CSVs into the Dropzone and wait for your browser to translate them into your Capital Gains Tax CSV formatted for TurboTax. Cryptocurrency is considered a form of property by the IRS and is subject to capital gains tax upon disposal and ordinary income tax when earned.

Your Crypto Tax Questions Answered Lexology

The original software debuted in 2014.

Robinhood crypto tax calculator. 2018 – Robinhood Crypto 1099 CSV Select Download CSV. Youll receive a corrected Robinhood Securities IRS Form 1099 andor Robinhood Crypto IRS Form 1099 if any corrections were made to your 1099s. Click on the Import and choose Add Account.

Though you can file your Robinhood taxes separately using your Consolidated 1099-B if youre using any other crypto exchanges or wallets these wont be included in your 1099-B form. This issue is not exclusive to only the turbotax software it is included in all tax. With Robinhood you can earn both ordinary and qualified dividends.

Simply follow the steps given below Login to your ZenLedger account. The tax rates you pay on cryptocurrency fluctuate based on your tax bracket as well as depending on whether it was a short term vs. Follow the instructions and well calculate the gain or loss from.

For more information on how cryptocurrency taxes check out our Ultimate Guide To Cryptocurrency Taxes. Crypto Taxes on Robinhood The IRS considers cryptocurrency property for the purpose of federal income taxes. 2018 Robinhood Crypto 1099 CSV Select Download CSV.

Download your Transaction History CSV for all time from Coinbase Robinhood Binance Kraken etoro or whatever crypto exchange you use. No matter if you are a day trader or long term investor filing your Robinhood 1099 taxes is simple but only with the proper guidance. Some were gains and some were losses.

So if youre reporting crypto transactions for multiple platforms Koinly makes it simple. This makes tax reporting very easy because people can rely on the 1099-B to report crypto gains and losses on their tax return. Calculate and prepare your Robinhood taxes in under 20 minutes.

In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return. Robinhoods investing platform doesnt withhold taxes when you sell securities or receive dividends on your Robinhood stocks. To download your Robinhood transaction history as a CSV.

BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. Suppose you have downloaded the CSV format of your Robinhood tax documents. Why is Robinhood different.

Lets understand how you can use ZenLedger to calculate taxes. Some crypto investors are wondering if they could aggregate crypto trades in their Robinhood account with their crypto transactions in other exchanges and wallets when doing the overall crypto tax calculation. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

A person on the turbo tax live help page said this. However you can link Robinhood and import them. Make sure the top row is the CSV headers.

Import trades automatically and download all tax forms documents for Robinhood easily. Ordinary dividends are taxed at your ordinary-income tax rate. With more than 15K customers this crypto tax calculating application simplifies crypto tax to investors and tax professionals.

Since then its developers have been creating native apps for mobile devices and other upgrades. But just having access to the crypto tax calculator isnt. If you dont report income on your tax return from the platform that filed a 1099 on your behalf.

Youll receive a Robinhood Crypto IRS Form 1099 if you sold cryptocurrencies or received miscellaneous income in 2021. Some crypto investors are wondering if they could aggregate crypto trades in their Robinhood account with their crypto transactions in other exchanges and wallets when doing the overall crypto tax calculation. Koinly is a Robinhood crypto tax calculator and reporting tool.

Qualified dividends are certain dividends from US companies that qualify to be taxed at the long-term capital gains rateYou also have to meet a minimum holding period. To add your Robinhood transactions download the CSV export of your transactions and import it. Taxes On Dividends.

Open or continue your return. If you need any amendments made due to any transactional errors you can submit a review request and Robinhood will look into it to make sure you are reporting correctly. RobinHood did send me my tax documents and they seem nice to calculate my net for me after all my transactions.

Filing your taxes is already complicated but it can be more confusing if you have bought or sold cryptocurrency. Uses your cryptocurrency transaction history to generate a Schedule easily. Whether you used an automated crypto trading app or made the trades yourself a crypto tax calculator will make it much easier to calculate how much you owe and fill out your crypto tax report.

Select Start or Revisit next to Cryptocurrency. Select Federal from the left menu and Wages Income from the menu near the top. Robinhood crypto taxes Robinhood stocks and cryptocurrency trades.

Scroll down and select Show more next to Investment Income. Upload your CSV file. Remember when major exchanges send you a Form 1099 they file an identical copy with the IRS.

Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains. Whether you invest in stocks exchange-traded funds ETFs options or cryptocurrency Robinhood is an excellent platform to invest in your future while on a budget. Because Robinhood is not a native crypto company all crypto transactions currently.

On Robinhood click on Tax Documents. CoinTrackinginfo – the most popular crypto tax calculator. I made 100 transactions this year just with crypto on robinhood.

Yes all tax software start with that assumption as it is easier to calculate the correct tax refund andor tax balance due by asking the questions after you have input all of your income and expenses. A long term gain. ZenLedger is a crypto tax software that supports integration with more than 400 exchanges including 30 Defi Protocols.

ZenLedger is a popular and reliable crypto tax calculation software. This makes tax reporting very easy because people can rely on the 1099-B to report crypto gains and losses on their tax returns. I just want to confirm if this would be the right way of filing taxes for RobinHood.

Normally 1099-B forms dont work for crypto exchanges as theyre unable to track the cost basis and. Robinhood works differently than most crypto exchanges – so youve got a couple of options for reporting your Robinhood taxes. Guidelines are found in IRS Notice 2014-21 IRB 2014-16.

Crypto Tax Rates Complete Breakdown By Income Level 2022 Cryptotrader Tax

Robinhood Crypto Taxes Explained Cryptotrader Tax

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

Why Coinbase Stopped Issuing Form 1099 K To Customers And The Irs Cryptotrader Tax

Your Crypto Tax Questions Answered Lexology

Bit Coin Bitcoincryptocurrency Cryptocurrency Trading Cryptocurrency Bitcoin

Best Crypto Tax Software Reviews 2021 Tax Season Picnic S Blog

Cryptocurrency Taxes Guide 2022 How Why To Report Your Profits

Robinhood Crypto Taxes Explained Cryptotrader Tax

Koinly Blog Kryptowahrung Steuern News Strategien Tipps

Cryptocurrency Taxes What To Know For 2021 Money

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

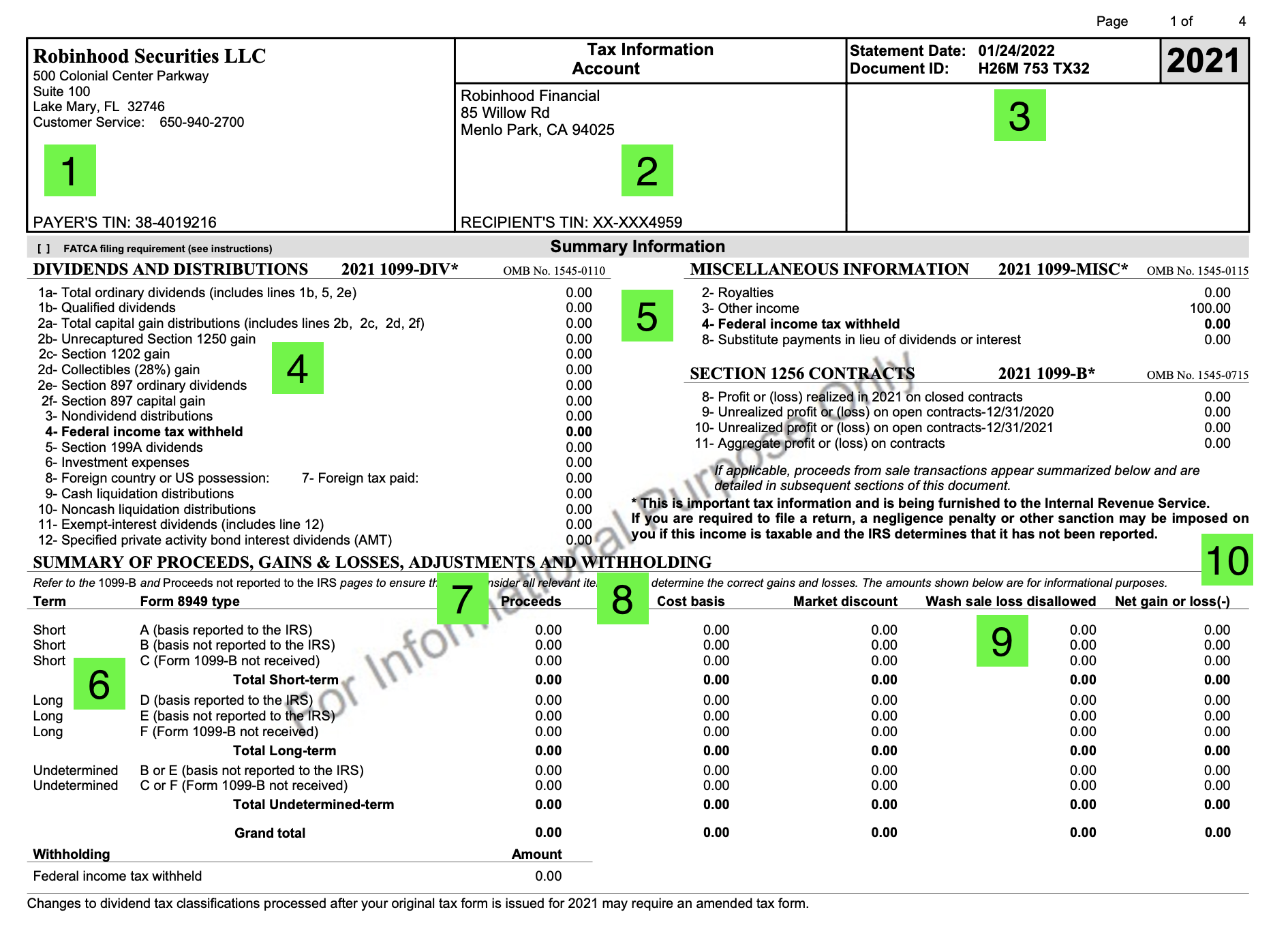

How To Read Your 1099 Robinhood

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

How Do Robinhood Crypto Taxes Work Koinly

Best Crypto Tax Software For New Zealand

Message Or Email Me For More Information And Let S Start Saving Tjones Sweeneyconrad Com How To Plan Bitcoin Let It Be

.png)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Cryptotrader Tax