Robinhood offers very little customer support but you can count on them to provide you with important tax documents at the end of the year. Theyre showing a 12300 net gain yet at the highest point ever early December my gain was 7500 and by the end of December it was closer to 5000.

Pin By Lynette Patoka On A Fixer Upper In 2022 Being A Landlord Money Saving Strategies Landlord Tenant

Navigate through the application and get to your tax documents.

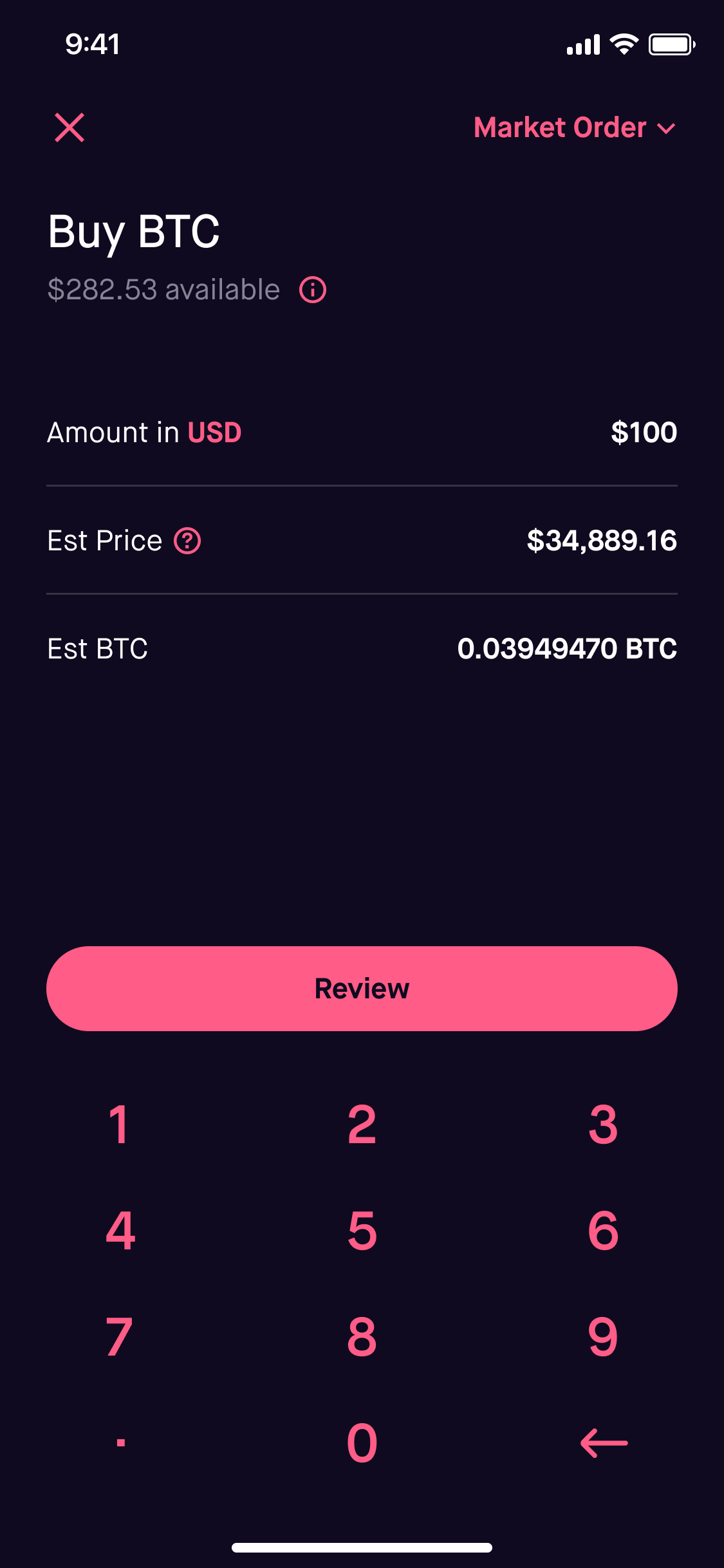

Robinhood crypto tax documents. Youll receive a Robinhood Securities IRS Form 1099 if you had a taxable event in 2020 including dividend payments selling stock for profit or exercising an option. For crypto transactions Robinhood provides a CSV. Upload your CSV file here.

When there are no dues left on your transactions you will receive the consolidated Robinhood tax documents which are nothing but detailed information about Form 1099. Robinhood Crypto provides users who sold crypto with a Consolidated Form 1099-B. You can download your 1099 form from the Robinhood app or website.

After logging into TurboTax navigate to the Wages Income section. How do I enter my crypto tax documents into TurboTax. It is vital that the correct Robinhood tax info is recorded in line with these updated 1099 forms.

This tax report includes all your disposals of crypto within the Robinhood platform. To download larger documents it is best to use Robinhoods web browser. Select the year Robinhood Crypto 1099 CSV.

No matter if you are a day trader or long term investor filing your Robinhood 1099 taxes is simple but only with the proper guidance. Robinhood Crypto provides its own separate consolidated 1099-B. At this time you do not need to import this 1099-B into specific crypto tax software like CryptoTraderTax.

That is what you turn in to TurboTax. How To Download Your Tax Documents. You have the option to view your documents in the app as well.

Similar to other types of tax documents received at year-end W2 etc you can import this 1099-B that you receive from Robinhood into tax filing software such as TurboTax or give it directly to your tax professional to file on your behalf. Youll receive a Robinhood Crypto IRS Form 1099 if you sold more than. Youll have a video call at the start then again when your return is ready to be filed.

You can find this under Tax Documents within your Robinhood account. One is the 1099-DIV. This information contains everything that you need to report your taxes-.

Robinhood usually sends all 1099 forms you may need in mid-February. Also basis and probably sales proceeds as well for your Robinhood trades in the aggregated tax report will not match the Robinhood 1099-B. Answer Yes when asked if you traded cryptocurrency.

This year you can also tap into TurboTax Full Service which means you upload your tax documents to a secure portal and a real live humanwhos assigned based on your specific tax needsputs your return together for a fee. You may have multiple forms if you have done transactions through Robinhood Securities and Robinhood Crypto during the year. Just got my robinhood tax forms.

When Robinhood sends the 1099 forms. Whether you invest in stocks exchange-traded funds ETFs options or cryptocurrency Robinhood is an excellent platform to invest in your future while on a budget. You can use this to declare your Robinhood crypto taxes separately.

H R Block is pretty competitive here. Select Robinhood and continue. Go to Statements.

How to access Robinhood tax documents. What tax documents we provide. Robinhood Securities provides a consolidated 1099 document which includes information from your 1099-DIV 1099-MISC 1099-INT and 1099-B.

Important Robinhood Tax Documents. Since its a financial services company expect to receive the following tax forms from Robinhood. You can find it under Statements If youre on the app tap the account icon tap.

In Robinhood you should see you also got a file called Robinhood Crypto CSV. Go to your account through the bottom right icon. When uploading Robinhood crypto transactions to TurboTax you wont need the document ID.

Is Robinhood secure when it comes to producing and recording tax information. The 1099-B form is what you need to submit to the IRS so that they can keep track of your capital gains or losses for the year. Also if you need a corrected 1099 it will be available from Robinhood at the end of March.

I got the instructions off the Robinhood website. The purchase and subsequent sale of crypto must be recorded on the Robinhood Crypto IRS Form 1099. How to get Robinhood tax forms.

Does Robinhood provide a tax report. If you mix Robinhood crypto trades with other crypto trades one problem you need to deal with is the crypto tax report you generate by using a crypto tax software will not provide the breakdown between Box A and Box C. In TurboTax when click Add investments you instead go to the bottom and select Enter a different way.

In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return. Instead youll need to upload the CSV file that comes with the crypto 1099 form into the tax software. They have managed to create a reliable.

This form reports your dividend income and details any. Cryptocurrency may be under the Investment Income subsection. Log in to Robinhood and click on Tax Documents.

Youll likely receive only one statement but it will include multiple tax documents as necessary. It can be that an updated form is sent to you. Depending on your account activity throughout the year you may receive one or more of the following documents.

On the screen where you enter income find the Cryptocurrency Start button in TurboTax. The steps to do so are as follows. If youve engaged in the trade of cryptocurrencies youll receive it from Robinhood Crypto not the main company itself.

Before doing this make sure you have the most updated version of the app. I dont quite understand whats happening with wash sales but it.

Us Treasury Suggests Miners Won T Be Subject To Irs Reporting Rules In 2022 Letter Addressing Investing Irs

How To Read Your 1099 Robinhood

How Do Robinhood Crypto Taxes Work Koinly

Robinhood Is Planning To Go Public Here S What We Know Initial Public Offering How To Plan Public

How To Report Robinhood Crypto Transactions Crypto Tax Advisors

What The 13b E Trade Deal Says About Robinhood S Valuation Techcrunch E Trade Start Up Wealth Management

Cryptocurrency Taxes What To Know For 2021 Money

M1 Finance Vs Robinhood Which Is Better In 2021 Finance Finance Tips Personal Finance

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

Robinhood Snacks Etf Trading Cash Management Financial News

Sec Sedang Menyelidiki Penanganan Robinhood Atas Perdagangan Gamestop In 2021 Securities And Exchange Commission Blockchain Bitcoin

Major Crypto Companies Announce Plan On Money Laundering Privacy In 2022 How To Plan Money Laundering Company

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

Mysolo401k Review Self Directed Solo 401k Accounts And Sdiras In 2021 Smart Investing Investing Personal Finance

Cryptocurrency Investing Robinhood

I Tried To Become A Millionaire Selling Nfts In 2021 Become A Millionaire How To Become Internet Culture

Meet Heather Morgan The Rapper And Forbes Contributor Arrested In The 4b Bitcoin Heist In 2022 Heather Morgan Rapper Arrest