I just want to confirm that it gets calculated like that on Robinhoods end as well since the platform is mostly for stocks. Im sure no one loses money in this sub but has anyone thought about tax loss harvesting.

Robinhood Crypto Taxes Explained Cryptotrader Tax

This tax strategy is known as tax-loss harvesting and it can help make up for any losses you saw.

Robinhood crypto tax loss harvesting. The Robinhood Investor 2021 Tax Guide. Most robo-advisors are set up to handle tax-loss harvesting automatically. This strategy is known as tax-loss harvesting and if youre sitting on any stock investments that just didnt go your way keep it in mind as the end of 2020 approaches.

Does Crypto tax loss harvesting work on Robinhood. Say you get laid off but you finally have an opportunity to go on a road trip with your familyTax-loss harvesting is a way to still get some benefit out of losing money on your investments. Anyone know how the rules apply to crypto.

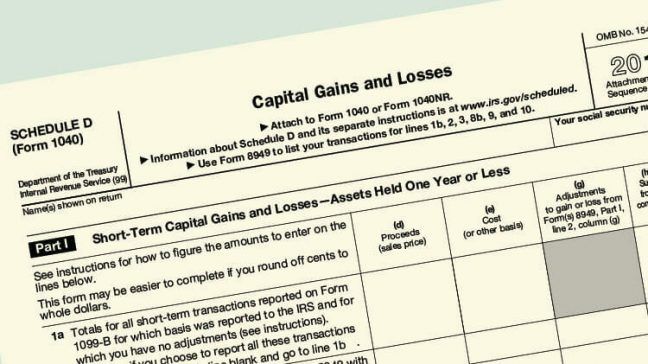

If you rebuy a crypto asset after the 30 day period passes your actions no longer classify as wash sale trading. Youre reading a free article with opinions that may differ from The Motley Fools Premium Investing. Again this is because all of your gains losses cost basis and proceeds are already completely listed out on the 1099-B that you receive from Robinhood.

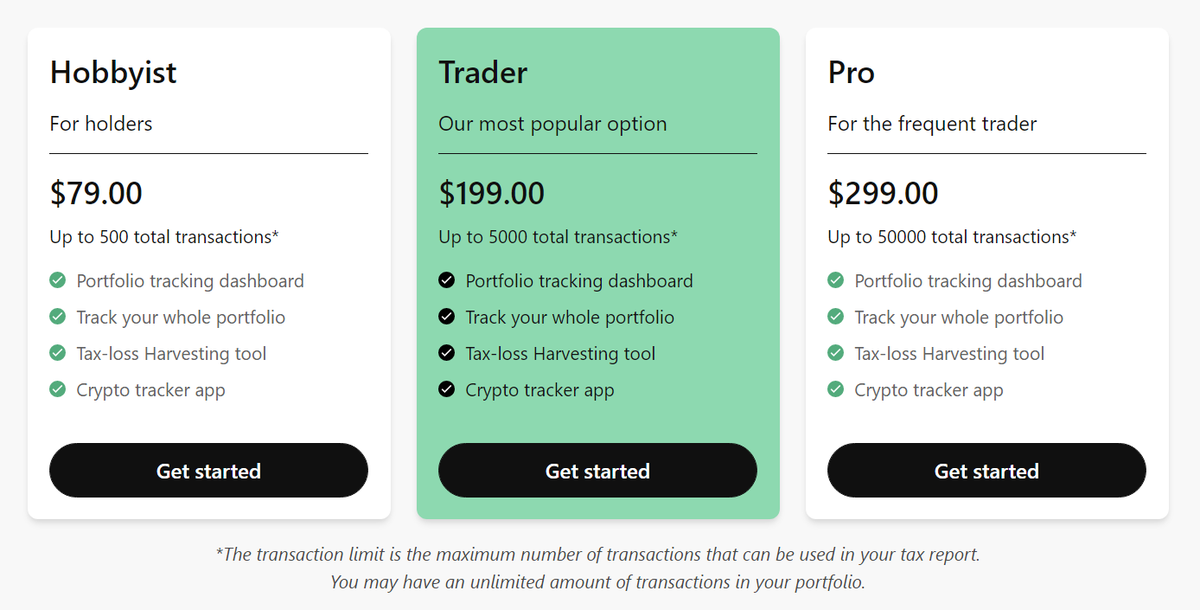

Tldr CoinTracker assists you in reducing your tax bill with our Tax Loss Harvesting Tool available with a Pro subscription of Portfolio Assistance. This applies to those who sold or spent their cryptocurrency those who exchanged one cryptocurrency for another and those who engaged in early taxable events such as earning. The third route is to just start trading elsewhere and leave your holdings in Robinhood.

Safer crypto tax loss harvesting. The IRS will deny this loss as a way to stop people from purposefully incurring large tax losses. And can help you choose the right reporting strategy with our Tax Loss Harvesting tool.

If you need any amendments made due to any transactional errors you can submit a review request and Robinhood will look into it to make sure you are reporting correctly. One massive difference though is that Robinhood does not This makes tax reporting very clean because human beings can depend on the 1099-B to report crypto gains and losses on their tax go back. At this time you do not need to import this 1099-B into specific crypto tax software like CryptoTraderTax.

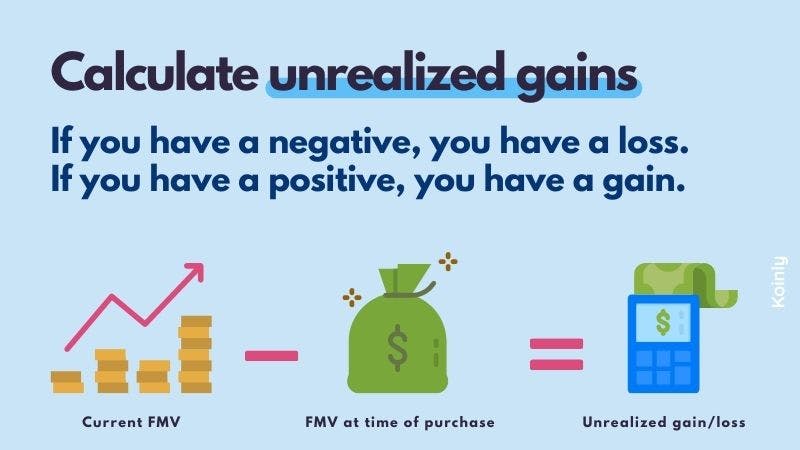

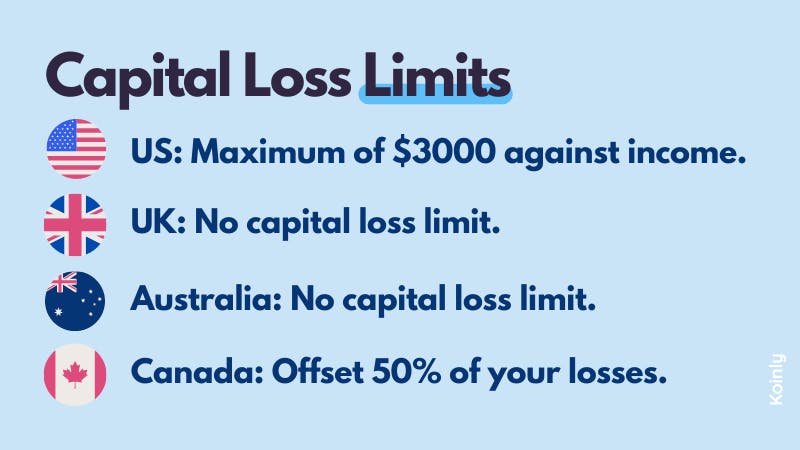

As you may have seen in CoinTrackers 2021 Crypto Tax Guide for most people the largest expense over the course of a year is not their rent housing car payment or food. We give you the choice. By selling your assets by the end of the year at a loss and buying them back at the lower price you deduct these losses from your gains and save up to 3000 on your taxes.

It s formally tax season and if you were among the many trade cryptocurrency this past year it s time to report your activity on your 2021 tax reappearance. Of course this may not be a bad thing. File with our expert tax filing team or easily take your.

By Charlene Rhinehart CPA – Feb 3 2021 at 833AM. You cant buy the same. Crypto Taxes on Robinhood The IRS considers cryptocurrency property for the purpose of federal.

This is fairly surprising given that tax-loss harvesting is a common feature among robo-advisors. Meaning selling an asset at a loss and buying it right back before the year end. Robinhood Doesnt Allow For Automated Tax-Minimizing Strategy.

Simply import your data and we will take care of the rest. Either SoFi Invest nor Robinhood offer tax-loss harvesting. Best Crypto Exchange 2022.

Tax-loss harvesting is like finding a silver lining When bad things happen they can sometimes come with some consolation. Be cautious of tax-loss harvesting if you are planning to sell off cryptocurrency youve purchased within the past 12 months. With crypto tokens wash sale rules dont apply meaning that you can sell your bitcoin and buy it right back whereas with a stock you would have to.

Found that utilizing tax-loss harvesting strategies increased after-tax returns by 082 percent. In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return. Calculate your cryptocurrency taxes and get your IRS compliant tax reports.

Compare price features and reviews of the software side-by-side to make the best choice for your business. If you incur any crypto losses outside of Robinhood anytime in 2021 exit Robinhood at a profit Chandrasekera wrote. As a result crypto trades arent subject to the wash sale rule and investors are taking advantage of that to minimize their tax exposure.

You can use those outside losses to offset the Robinhood exit tax bill vice versa. There are safer ways to harvest losses on a crypto asset. One approach is to trade the depreciated asset for a coin with which its price is closely correlated hold that correlated coin for more.

You are planning to liquidate your holdings soon. Robinhood affords a crypto buying and selling platform much like crypto exchanges which includes Coinbase Gemini Bittrex and so on. A wash sale is when you sell a security at a loss and then buy that same security or one that is nearly identical within 30 days.

When you sell your assets such as stocks or crypto at a loss in order to offset a capital gain it is known as tax-loss harvesting. There is no need to include this information twice on your tax return. Robinhood using this comparison chart.

If you do sell your tokens you will need to pay the short-term capital gains rate 10-37 rather than paying the long-term capital gains rate 0-20 which may apply. Tax-Loss Harvesting IRS Forms Capital Gains Report TurboTax integration TaxAct Integration Start for Free. Yes it does in the DIY way tax loss harvesting is just selling stocks at a loss and buying equivalent ones or wait 30days and if that stock you sold continued to.

The IRS has a wash-sale rule in place that disallows harvesting losses for tax purposes.

What Is Tax Loss Harvesting Forbes Advisor

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

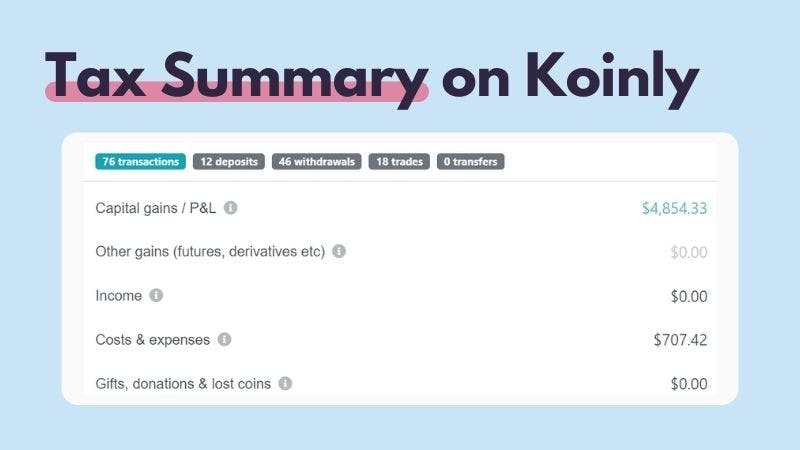

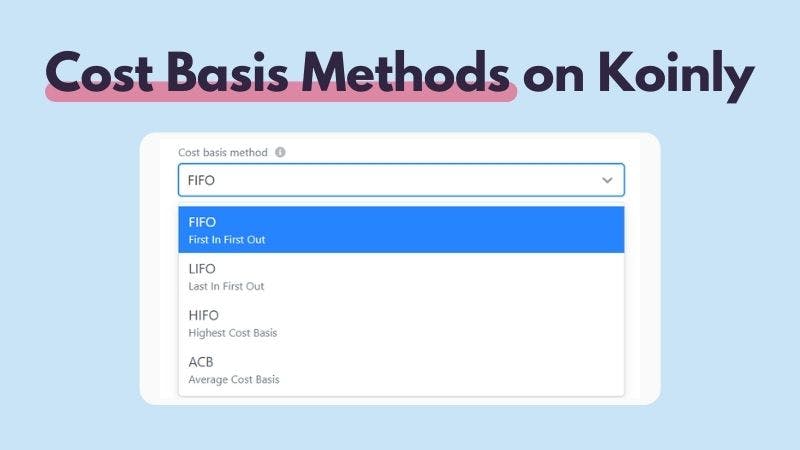

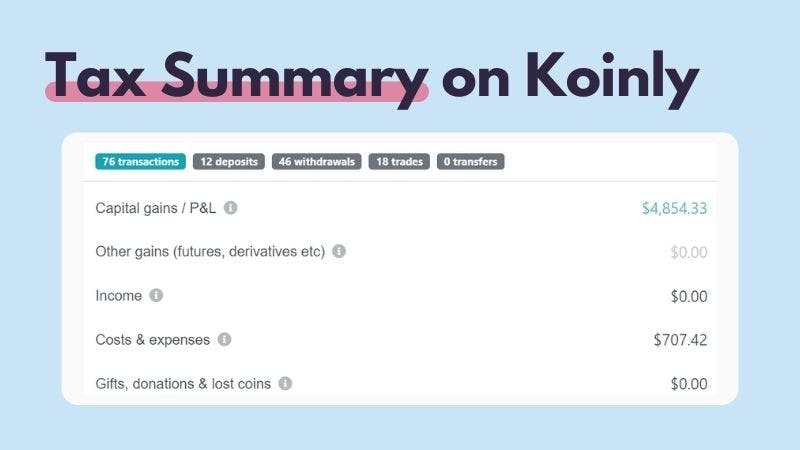

Crypto Tax Loss Harvesting Investor S Guide Koinly

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Crypto Tax Loss Harvesting Investor S Guide Koinly

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Crypto Tax Loss Harvesting Investor S Guide Koinly

Automated Tax Loss Harvesting Is It Right For You Money Under 30

Crypto Tax Loss Harvesting Investor S Guide Koinly

Crypto Tax Loss Harvesting Investor S Guide Koinly

Blockonomics Blockonomics Co Twitter

Save Thousands By Tax Loss Harvesting Your Crypto Before The End Of The Tax Year R Cryptocurrency

Free Finance Images 2021 Infographics Illustrations Photos More

Crypto Tax Loss Harvesting Investor S Guide Koinly

A Quick Guide To The Wash Sale Rule And Cryptocurrency Taxbit Blog

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax