If you mix Robinhood crypto trades with other crypto trades one problem you need to deal with is the crypto tax report you generate by using a crypto. Robinhood Crypto IRS Form 1099.

Crypto Trading On Robin Hood It S Not Good By Aaron Fernando Medium

Long term gain – Assets that are held for a year or longer with no trades.

Robinhood crypto tax percentage. Crypto trades on other crypto exchanges though will need to have Box C checked because no 1099-B is provided. Robinhood Crypto IRS Form 1099. You must however pay income tax on any profits you make when you sell your crypto.

Profits from investments held for less than one year can be subject to a capital gain tax of as high as 37 percent whereas profits from those held for. People were saying that you cant attach a PDF to turbotax but I just did. Robinhood is a fintech company that operates an online discount brokerage that offers its users commission-free trading.

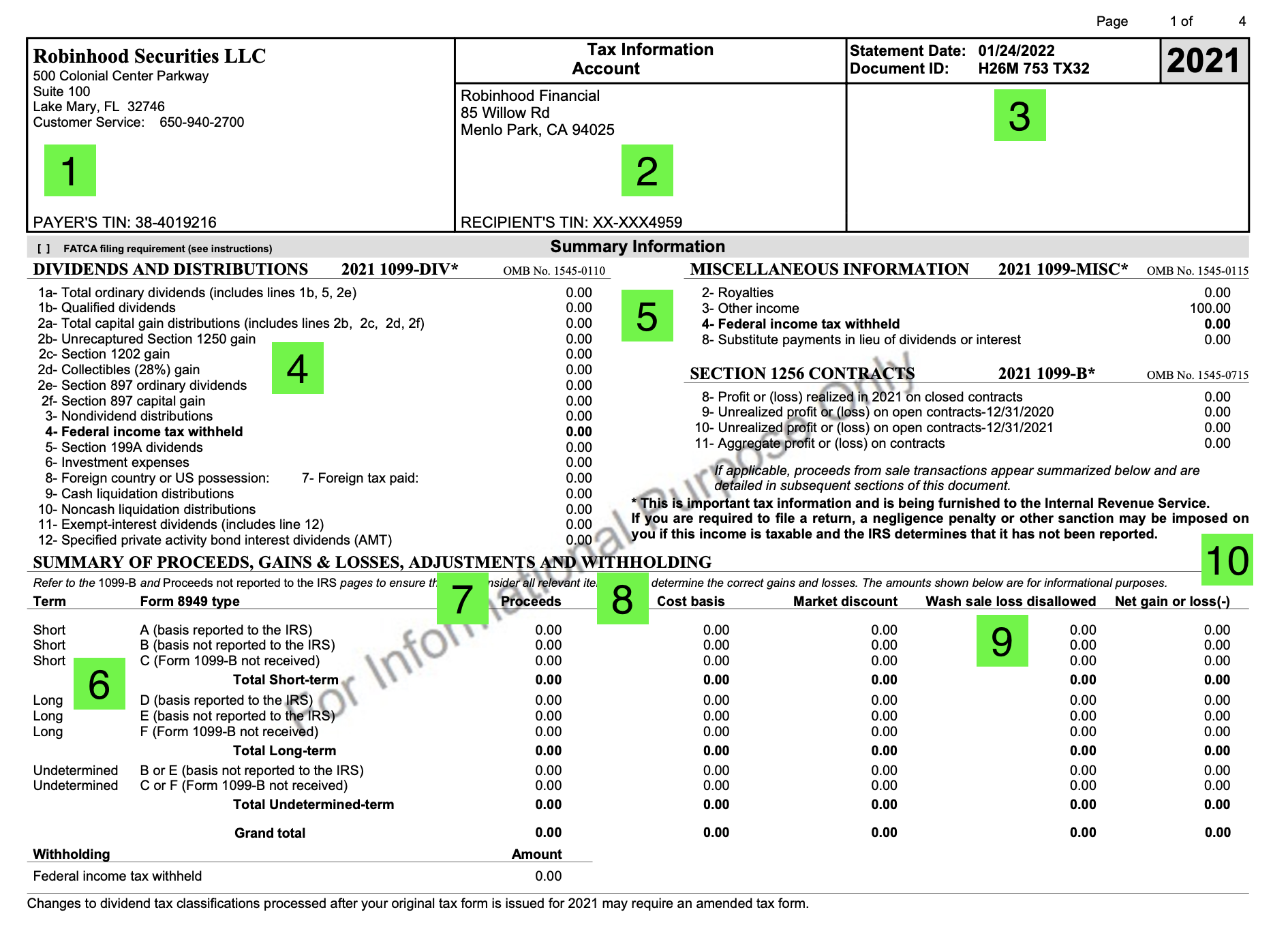

Youre likely to receive the Robinhood Crypto IRS Form 1099 if you had sold your crypto assets anytime in 2020. Robinhood gives you the opportunity to trade and invest in stocks crypto ETFs etc at zero commissions. For any cryptocurrency activity that took place last year an accompanying PDF and CSV file will be sent to you.

The services provided by Robinhood are quite similar to SoFi and TD Ameritrade. The first 9875 of your income falls into the first tax bracket which has a tax rate of 10. Robinhoods 1099-B form does work though.

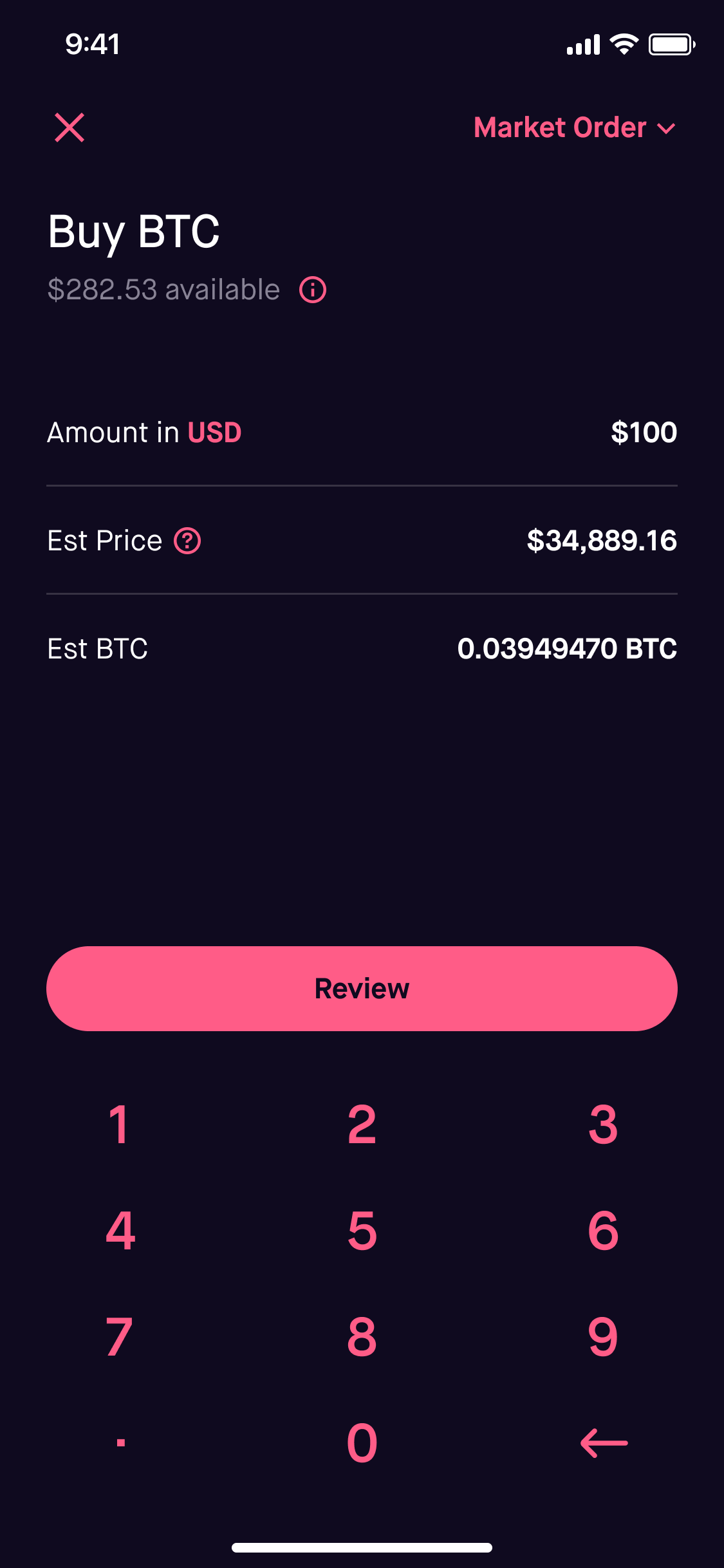

Not all brokers allow you to buy and sell cryptocurrency but robinhood offers support for multiple cryptocurrencies including bitcoin dogecoin and ethereum with robinhood crypto open 247. One of the best-known tax deductions is for charitable donations which you can generally claim up to 60 percent of your adjusted gross income. Your income falls into three different federal tax brackets.

The exact percentage you pay is the same as your income tax bracket. Youll receive a Robinhood Crypto IRS Form 1099 if you sold cryptocurrencies or received miscellaneous income in 2021. This is a tax levied on profits made from selling capital assets including stocks and cryptocurrency.

This consolidated information is provided by Robinhood. After you apply the standard deduction of 12400 your taxable income is 37600. It can be 0 15 or 20 depending on your tax bracket.

However the proceeds or profits you make from your sales are subject to capital gain tax. At least 8 million people opened new brokerage accounts in the. As is true with stock both short- and long-term capital gains tax rates apply based on how long you held the currency.

Okay guys I found a work around for turbotax. If you need any amendments made due to any transactional errors you can submit a review request and Robinhood will look into it to make sure you are reporting correctly. Though you can file your Robinhood taxes separately using your Consolidated 1099-B if youre using any other crypto exchanges or wallets these wont be included in your 1099-B form.

Trading crypto on Robinhood is easy and hassle-free. Suppose you make an annual salary of 35000. Robinhood restricts crypto trading as Dogecoin soars 300 percent The Verge.

Short-term capital gain tax rates are similar to ordinary income tax rates and can be as high as 37 percent. So if youre reporting crypto transactions for multiple platforms Koinly makes it simple. When it comes time to file your taxes you can deduct your donation.

Youll receive a Robinhood Securities IRS Form 1099 if you had a taxable event in 2021 including dividend payments interest income miscellaneous income or if you sold stocks mutual fundsETFs or options. 5 of money cashed out. Ranging from 10 to 10000.

The IRS 1099 tax forms that youll receive are from Robinhood Securities as well as Robinhood Crypto. Found that utilizing tax-loss harvesting strategies increased after-tax returns by 082 percent per year. Koinly is a Robinhood crypto tax calculator and reporting tool.

One year you donate 1000 to your favorite charity. Robinhood has started restricting trading in cryptocurrencies this morning just as the price of joke cryptocurrency Dogecoin has soared more than 300 percent in 24 hours. Have a great day or night guys.

You can trade stocks Exchange Traded Funds ETFs cryptocurrencies and options. In a nutshell you pay less in taxes by holding investments longer. Short-term capital gains are from investments you own for 1 year or less.

There are no tax consequences when you purchase crypto or transfer it between online wallets established in your name. Again this is because all of your gains losses cost basis and proceeds are already completely listed out on the 1099-B that you receive from Robinhood. In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return.

Long-term gains are taxed at either 0 15 or 20 depending on your ordinary income tax bracket. You should be reporting gains or losses whenever you either cash out or exchange one coin for another. There is no need to include this information twice on your tax return.

Robinhood works differently than most crypto exchanges – so youve got a couple of options for reporting your Robinhood taxes. I just worked on this one individuals crypto tax reporting and its so tedious to do. At this time you do not need to import this 1099-B into specific crypto tax software like CryptoTraderTax.

Fees not only does robinhood offer free trades on stocks options etfs and adrs but it also has no account fees inactivity fees or ach transfer fees. The IRS will likely look for amounts under Box A to match the 1099-Bs they received. Finally you can deduct losses from Robinhood stock or.

10 12 and 22. Now your income only falls into two tax brackets. Normally 1099-B forms dont work for crypto exchanges as theyre unable to track the cost basis and disposals of deposited and withdrawn crypto assets.

Robinhood Crypto Taxes. I have all kinds of transaction. Robinhood Doesnt Allow For Automated Tax-Minimizing Strategy.

The purchase and subsequent sale of crypto must be recorded on the Robinhood Crypto IRS Form 1099. Buying and selling stocks on apps such as Robinhood last year when they were cut off from other pastimes during pandemic lockdowns. Long-term capital gains are for investments you own for over 1 year.

It can be that an updated form is sent to you. All good and no review flags from turbotax. If you have the crypto tax document from Robin Hood You just have to enter it manually as a summary and attach the pdf 1099b from Robin Hood.

How To Read Your 1099 Robinhood

Cryptocurrency Investing Robinhood

How Do Robinhood Crypto Taxes Work Koinly

Crypto Grows From 2 To 41 Of Robinhood S Total Revenue In Past Year

Robinhood Crypto Taxes Explained Cryptotrader Tax

Crypto Grows From 2 To 41 Of Robinhood S Total Revenue In Past Year

Using An Easy Stock Trading Mobile App App Development Investing Apps Online Stock Trading

10 Best Crypto Hot Wallets For Beginners Alexandria

Top 3 Apps For Investing Investing Investing Apps Finance

A New Generation Of Investors Crypto And Robinhood Under The Hood

10 Best Robinhood Alternatives You Should Use In 2021 Beebom

Does Robinhood Report To Irs Wealth Quint

Robinhood Taxes Explained 2022 How Are Investment Taxes Handled

How To File Robinhood 1099 Taxes

Robinhood Crypto Taxes Explained Cryptotrader Tax

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

Robinhood Is Planning To Go Public Here S What We Know Initial Public Offering How To Plan Public

Icymi Forex Trading Bitcoinrts Btc Altcoin Litecoin Robinhood S Zero Fee Crypto Trading What Is Bitcoin Mining Investing In Cryptocurrency Bitcoin

Robinhood Is Planning To Launch Cryptocurrency Wallets As Btc Becomes A Main Percentage Of Business