Robinhood Crypto IRS Form 1099. Unlike most other cryptocurrency exchanges Robinhood does not allow its users to transfer cryptocurrency into or out of its platform.

Robinhood Crypto Trading Platform Review Techradar

They will be able to purchase and hold their shares on the cryptopia platform why is robinhood against day trading as well as trade bitcoin through the btobit platform.

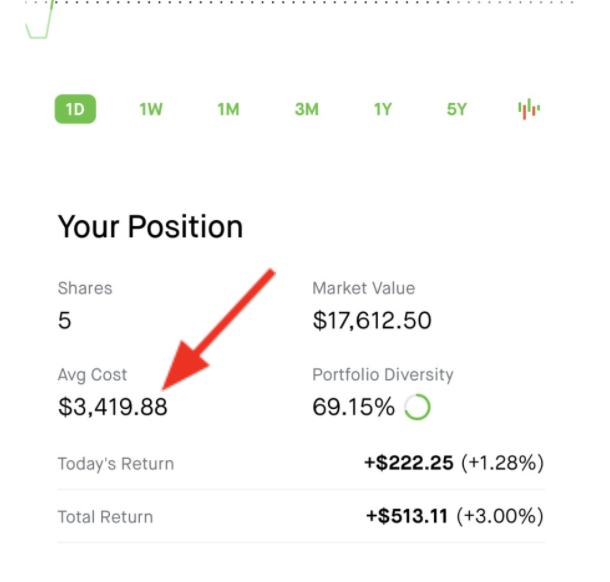

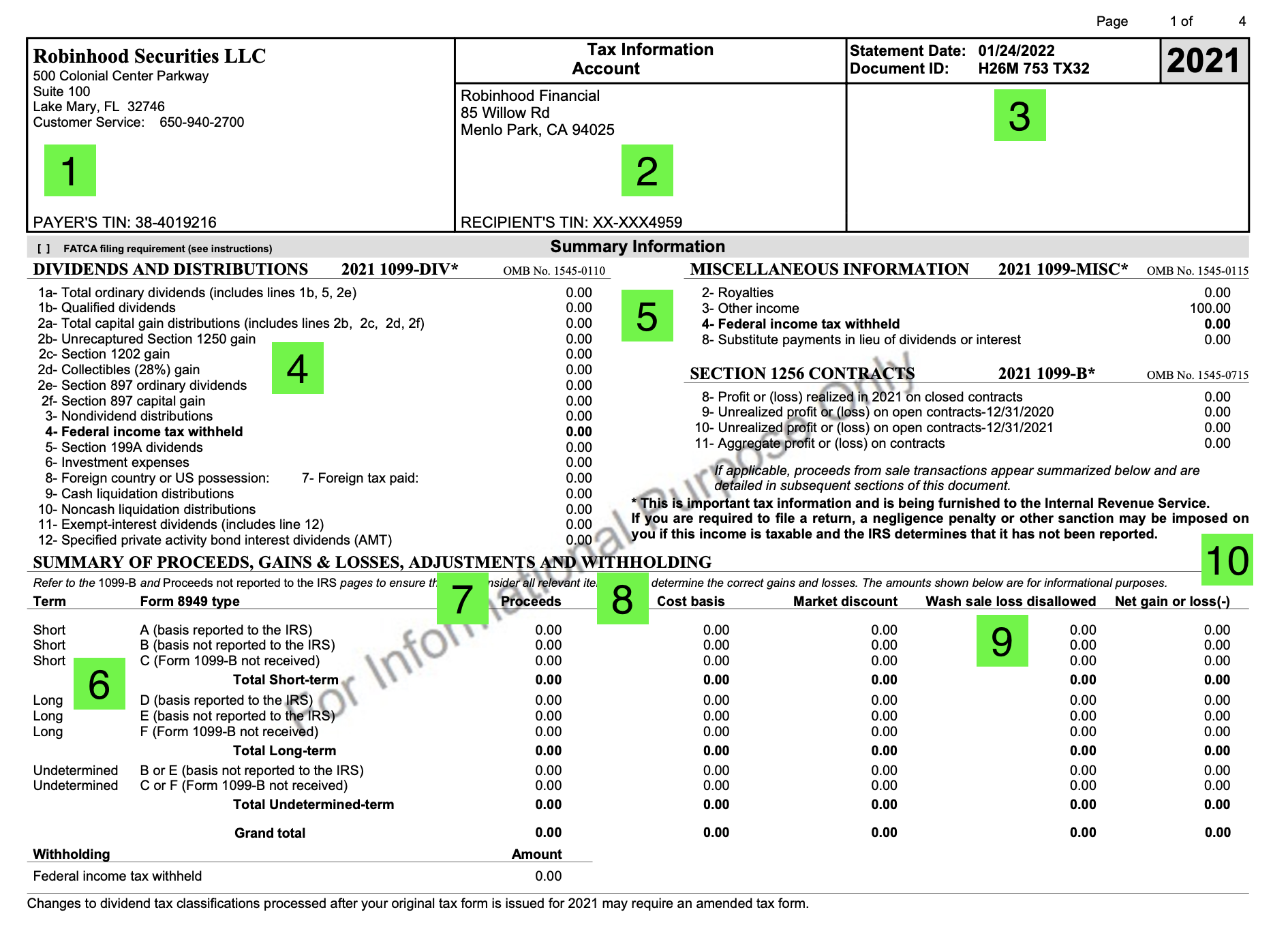

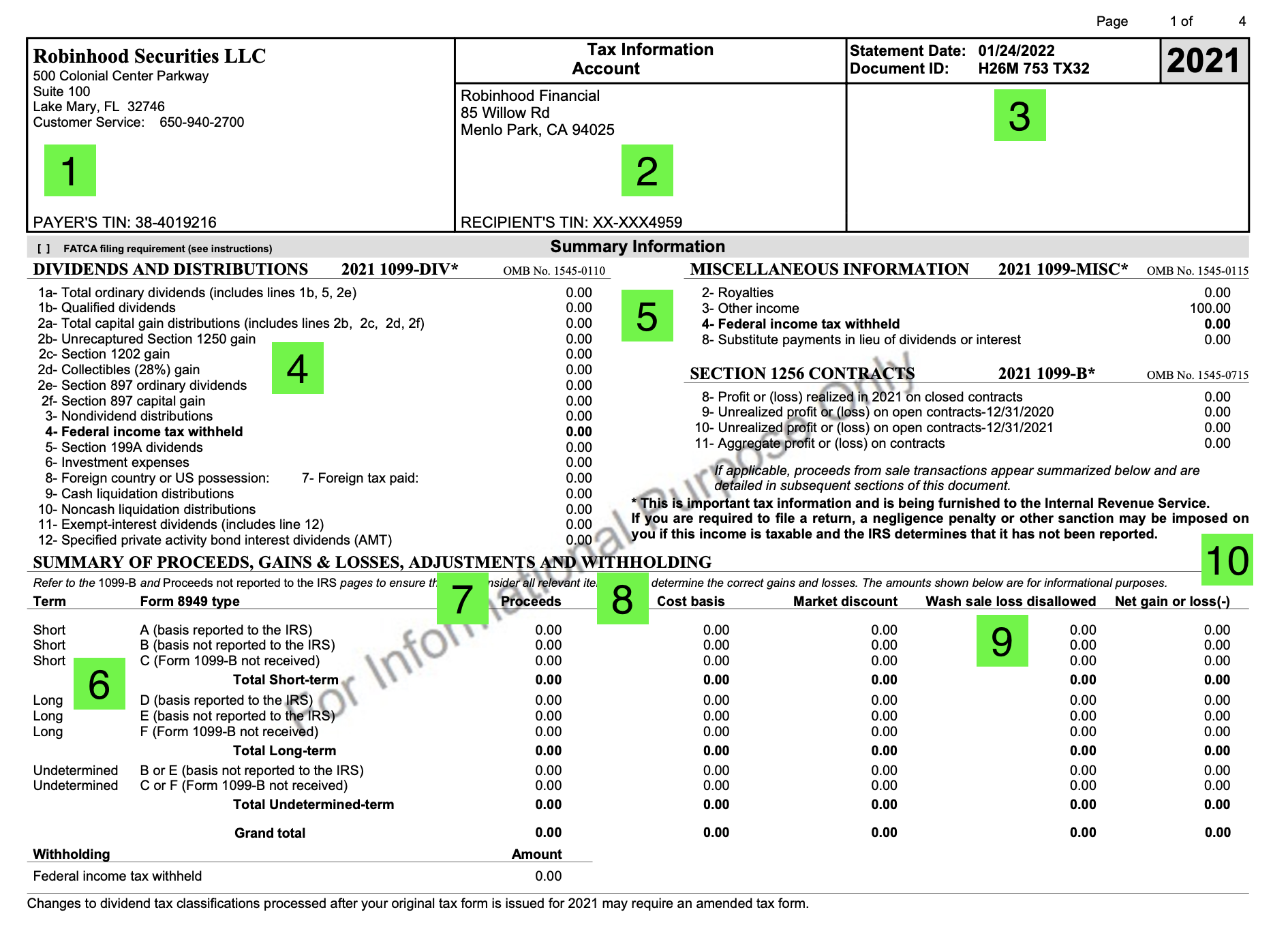

Robinhood crypto trading tax. To get started with your Robinhood crypto taxes youll need your complete Robinhood crypto transaction history or your 1099-B form. Some crypto investors are wondering if they could aggregate crypto trades in their Robinhood account with their crypto transactions in other exchanges and wallets when doing the overall crypto tax calculation. The services provided by Robinhood are quite similar to SoFi and TD Ameritrade.

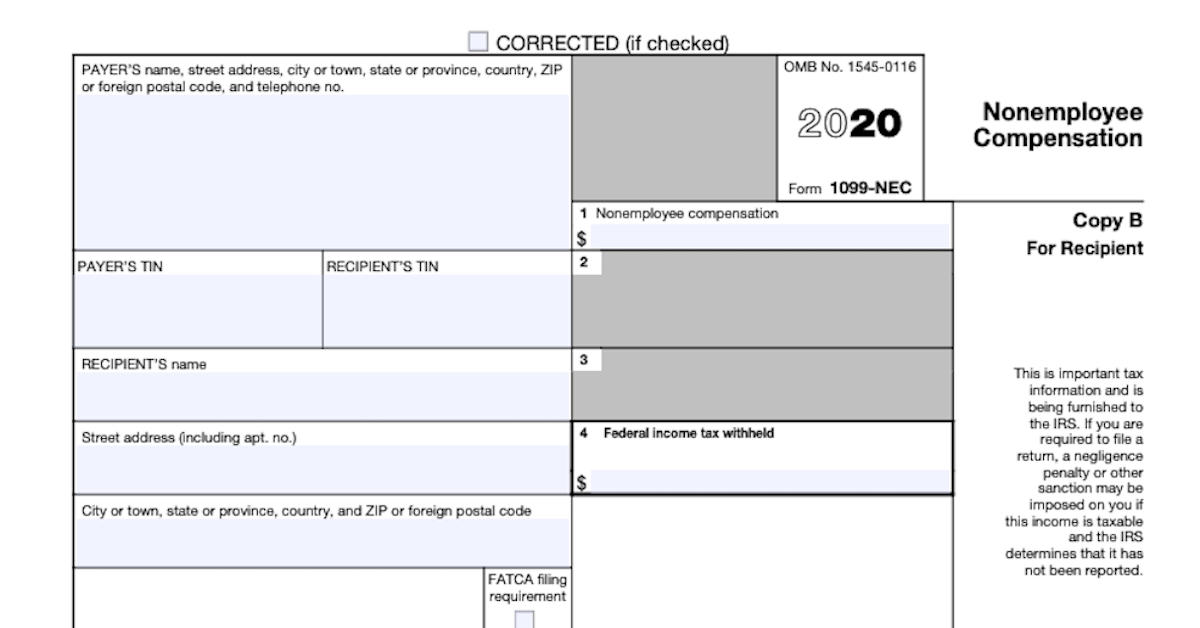

You can trade stocks Exchange Traded Funds ETFs cryptocurrencies and options. It can be that an updated form is sent to you. People were saying that you cant attach a PDF to turbotax but I just did.

How to keep track of crypto for taxes. This consolidated information is provided by Robinhood. Robinhood customers are protected up to 500000 including up to 250000 in cash balances.

Taxes On Capital Gains. If you have the crypto tax document from Robin Hood You just have to enter it manually as a summary and attach the pdf 1099b from Robin Hood. If there is a loss then you will have a capital loss.

Day trading crypto or stocks on Robinhood is essentially the same as trading crypto on a centralized exchange like Coinbase or Binance. Okay guys I found a work around for turbotax. Robinhood Crypto IRS Form 1099.

In a regular taxable brokerage account any sell trades resulting in a gain or loss will incur a taxable event. How to download export Robinhood crypto trading transaction history. No matter if you are a day trader or long term investor filing your Robinhood 1099 taxes is simple but only with the proper guidance.

The IRS 1099 tax forms that youll receive are from Robinhood Securities as well as Robinhood Crypto. While Robinhoods app may glitter its lack of automated tax-saving options may cause you to lose out on a lot of gold. Robinhood is a fintech company that operates an online discount brokerage that offers its users commission-free trading.

All good and no review flags from turbotax. Have a great day or night guys. I thought they – Answered by a verified Tax Professional.

India Crypto TAX. When you trade stocks and bonds brokerages are required to provide you with a 1099 or similar tax forms with all the information you need to report gains. STOP CRYPTO Trading from 1st April 2022.

As of this writing you can only buy sell and trade on the Robinhood platform. Cryptocurrency exchanges like Coinbase have garnered millions of users and trading apps like Robinhood make it as easy to buy and sell bitcoin ethereum and other digital coins as it is to trade. Just like other forms of propertystocks bonds real estateyou incur a tax reporting requirement when you sell trade or otherwise dispose of your cryptocurrency for more or less than you acquired it for.

Whether you invest in stocks exchange-traded funds ETFs options or cryptocurrency Robinhood is an excellent platform to invest in your future while on a budget. For more information on how cryptocurrency taxes check out our Ultimate Guide To Cryptocurrency Taxes. This will allow you to get a hold of a bitcoin that is in your possession.

Crypto market vs stock market size. For any cryptocurrency activity that took place last year an accompanying PDF and CSV file will be sent to you. Michael Saylor Anthony Scaramucci and Mark Yusko Interview 25 BILLION ETHEREUM LOCKED UP Ethereum 20.

There will be tax implications either way. In most countries cryptocurrencies like bitcoin are treated as property for tax purposes not as currency. Robinhood crypto taxes Robinhood stocks and cryptocurrency trades.

If you profit on the sale of the security it will result in a capital gain. Adding to the popularity of crypto is the rise of free-trading apps such as Robinhood that has made investing in all types of assets including crypto much more accessible for the everyday person. Robinhood has quickly grown its userbase to over 13 million and now the question is what about taxes.

Because Robinhood is not a native crypto company all crypto transactions currently. Crypto trading does not have this rule so traders can open an account with less than 25000. A long term gain.

The case should serve as a loud warning for the new crop of do-it-yourself investors. Youre likely to receive the Robinhood Crypto IRS Form 1099 if you had sold your crypto assets anytime in 2020. Robinhoods investing platform doesnt withhold taxes when you sell securities or receive dividends on your Robinhood stocks.

The tax rates you pay on cryptocurrency fluctuate based on your tax bracket as well as depending on whether it was a short term vs. March 29 2022 Robinhood Crypto Review Start Trading Cryptocurrency Today. But I have already filed my taxes.

Crypto taxes 101. Crypto End he. Is A 10000000 Bitcoin Possible.

Theres a couple of ways this works so lets dive in. Why is Robinhood different. This allows Robinhood to provide users with accurate tax documentation unlike Coinbase and other exchange giants.

Robinhood just sent me my crypto and stock trading tax documents. How much tax do you pay on stock gains. HUGE LITECOIN NEWS Robinhood Crypto Adds LTC.

Robinhood stocks and cryptocurrency trades might be subject to capital gain tax. This makes tax reporting very easy because people can rely on the 1099-B to report crypto gains and losses on their tax return. The purchase and subsequent sale of crypto must be recorded on the Robinhood Crypto IRS Form 1099.

The difference is that the Robinhood user interface is designed for beginners and is simpler than those of dedicated crypto exchanges designed for professional traders. Ethereum Price Prediction 2022 Ethereum News. A Robinhood newbie is facing a potential tax bill of 800000 despite only making 45000 in net trading profits.

Cryptocurrencies are excluded from this protection as they are not stocks. Basics Of Cryptocurrency March 29 2022 5 Best Cryptocurrency Exchanges to Trade Crypto Cryptocurrency Trading March 29 2022 Cryptocurrency Crash. Trading crypto on Robinhood is easy and hassle-free.

How Do You Pay Taxes On Robinhood Stocks

How To Read Your 1099 Robinhood

Robinhood Taxes Explained Youtube

Robinhood Crypto Taxes Explained Cryptotrader Tax

How To File Robinhood 1099 Taxes

Crypto And Taxes The Basics Part 1 By Dorian Kersch Lunafi Blog Medium

Are You A Robinhood Trader Here S What You Should Know About Taxes Weisberg Kainen Mark Pl

Tax For Stock Trading Robinhood Blind

Algorithmic Robinhood Crypto Trading With Python In The Cloud By Will Keefe Codex Medium

Robinhood Taxes Explained 2022 How Are Investment Taxes Handled

Robinhood Crypto Taxes Explained Cryptotrader Tax

Robinhood Crypto Trading Platform Launched Bitrazzi

How Do You Pay Taxes On Robinhood Stocks

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

How Do Robinhood Crypto Taxes Work Koinly

Well Robinhood S Zero Fee Crypto Trading Is Not Actually Free

How To Report Robinhood Crypto Transactions Crypto Tax Advisors

Cryptocurrency Taxes Guide 2022 How Why To Report Your Profits