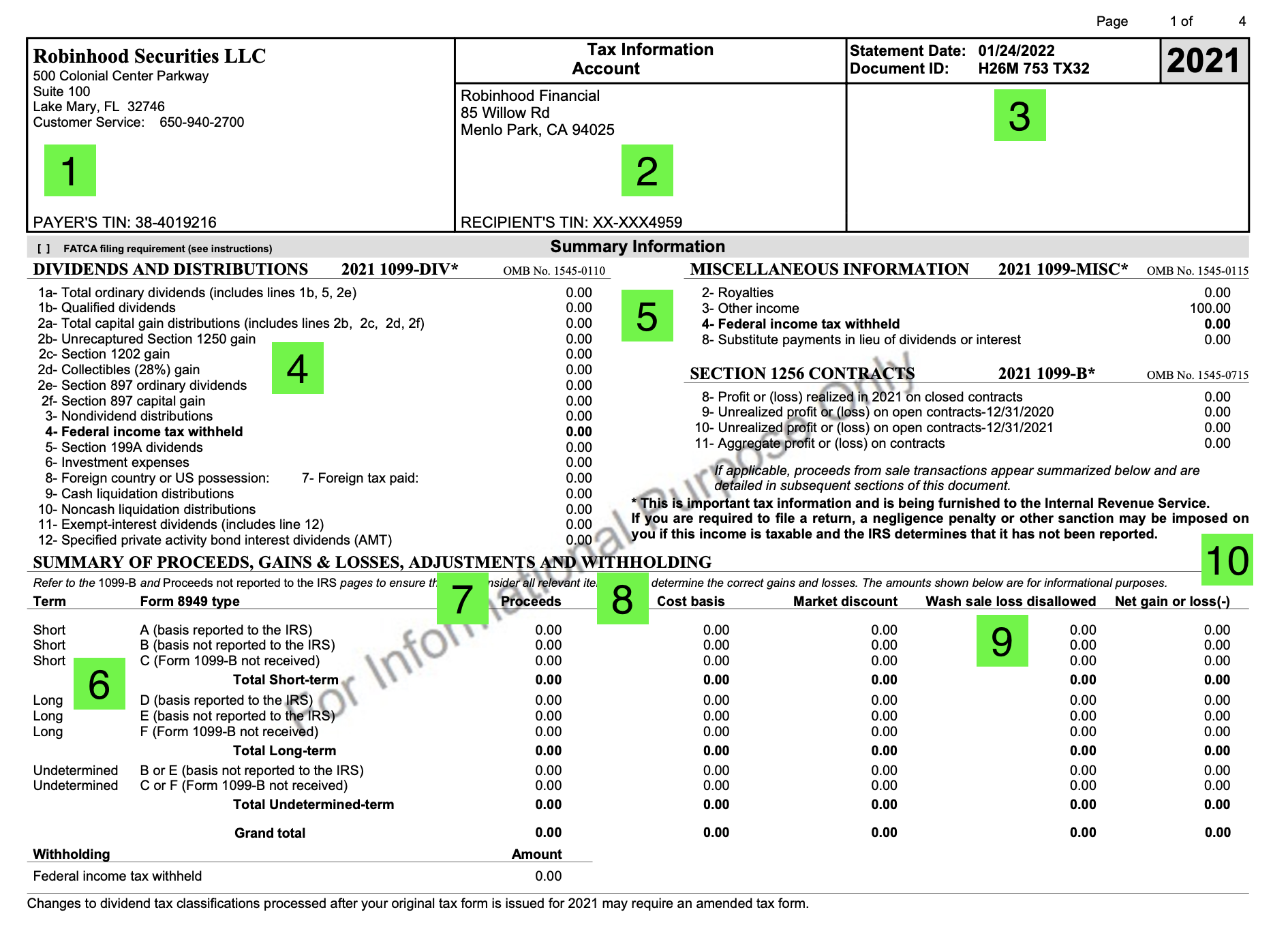

Robinhood crypto and form 8949 box B or C. It can be that an updated form is sent to you.

How Do You Pay Taxes On Robinhood Stocks

How to get Robinhood tax forms.

Robinhood cryptocurrency tax forms. This tax report includes all your disposals of crypto within the Robinhood platform. You can download your 1099 form from the Robinhood app or website. The purchase and subsequent sale of crypto must be recorded on the Robinhood Crypto IRS Form 1099.

That is what you turn in to TurboTax. Form 1099-MISC is designed to report miscellaneous income to taxpayers and the IRS. Navigate through the application and get to your tax documents.

Robinhood will send you a 1099 form which will allow you to pay all taxes on the money you earned or spent last year. The IRS 1099 tax forms that youll receive are from Robinhood Securities as well as Robinhood Crypto. In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return.

If youve engaged in the trade of cryptocurrencies youll receive it from Robinhood Crypto not the main company itself. You can use this to declare your Robinhood crypto taxes separately. Connecting your Robinhood account to CoinTracker.

The app allows you to invest in stocks and buy cryptocurrencies. Since its a financial services company expect to receive the following tax forms from Robinhood. 1099 is a document that shows your income.

Typically cryptocurrency disposals need to be reported on Form 8949. What is a 1099 form. You can find this under Tax Documents within your Robinhood account.

This makes tax reporting very easy because people can rely on the 1099-B to report crypto gains and losses on their tax return. The name of the issuing entity will be in the title of each document. -Got this today does anyone has any advice in this case.

Some crypto investors are wondering if they could aggregate. You might need any of these crypto tax forms including Form 1040 Schedule D Form 8949 Schedule C or Schedule SE to report your crypto activity. IRS Form 8949 for crypto tax reporting.

In TurboTax when click Add investments you instead go to the bottom and select Enter a different way. At this time you do not need to import this 1099-B into specific crypto tax software like CryptoTraderTax. What information is on the 1099 form.

All tax documents will be available in Mid-February for the previous tax year. So anytime youve disposed of crypto by selling it swapping it or spending it – youll include it on this form. 2018 – Robinhood Crypto 1099 CSV Select Download CSV.

You wont need any 1099 forms from Robinhood this year so you dont need to wait on us to start filing your taxes. In most cases exchanges choose to send Form 1099-MISC when a customer has earned at least 600 of income. If you use Robinhood to trade stocks and cryptocurrencies you may receive Form 1099 which youll need to file your tax return with the IRS.

Similar to other types of tax documents received at year-end W2 etc you can import this 1099-B that you receive from Robinhood into tax filing software such as TurboTax or give it directly to your tax professional to file on your behalf. Select the year Robinhood Crypto 1099 CSV. On Robinhood click on Tax Documents.

Robinhood Crypto provides users who sold crypto with a Consolidated Form 1099-B. This form is used to report any disposals of capital assets – in this instance cryptocurrency. Form 1040 The form has areas to report income deductions and credits and it is used to gather information from many of the other forms and schedules in your tax return.

Your consolidated 1099 form will come up in the mail from Robinhood Securities Robinhood Crypto or Apex Clearing. Youll receive a Robinhood Crypto IRS Form 1099 if you sold cryptocurrencies or received miscellaneous income in 2021. If you answer Yes to the Form 1040 question you will need to report all your crypto disposals and income events on your tax return.

The 1099-NEC form is replacing the Form 1099-MISC for miscellaneous income from previous tax years. Robinhood Crypto IRS Form 1099. TurboTax only lets you import the csv file and creates the 8949 form with box C checked which is what I would expect for crypto transactions.

In Robinhood you should see you also got a file called Robinhood Crypto CSV. Upload your CSV file here. This form reports your capital gains or losses from your investments.

Youre likely to receive the Robinhood Crypto IRS Form 1099 if you had sold your crypto assets anytime in 2020. Also similar to traditional brokerage firms Robinhood issues a Form 1099-B every year to their customers including both their sales proceeds and cost basis for each crypto trade. Upload your CSV file.

To add your Robinhood transactions download the CSV export of your transactions and import it. You can find it under Statements If youre on the app tap the account icon tap. Does Robinhood provide a tax report.

For tax year 2021 you may download your Robinhood Crypto Form 1099-B PDF file and submit it for processing. To download your Robinhood transaction history as a CSV. If you need any amendments made due to any transactional errors you can submit a review request and Robinhood will look into it to make sure you are reporting correctly.

In the Tax Documents section of the app you will see a list of your tax documents. Youll not only get the PDF format of the form but also a CSV format that can easily be imported into tax reporting. So the 2021 tax forms will be available Mid-February 2022.

Log in to Robinhood and click on Tax Documents. With tax season just around the corner you might be awaiting all sorts of documentation and forms. Tax Forms Robinhood Will Provide.

You can also make various other transactions. This form is typically used by cryptocurrency exchanges to report interest referral and staking income to the IRS. This form reports interest income earned from your investments.

You may receive tax forms from both Robinhood Securities and Robinhood Crypto. But looking through the 1099-B form it mentions that actually box B should be. However what about taxes on the money you earned.

Depending on when and what trades you made your form can show up from slightly different companies. Using robinhood crypto they send you a 1099-B and a csv file at the end of they year. If you are using the latest version of the app a document will be titled one of the following preceded by the tax year.

Youll receive a corrected Robinhood Securities IRS Form 1099 andor Robinhood Crypto IRS Form 1099 if any corrections were made to your 1099s. It is vital that the correct Robinhood tax info is recorded in line with these updated 1099 forms. The IRS Form 8949 is a supplementary form for the 1040 Schedule D.

How to access Robinhood tax documents.

.jpg)

Robinhood Crypto Taxes Explained Cryptotrader Tax

Margin Trading Crypto Robinhood Edukasi News

How Do You Pay Taxes On Robinhood Stocks

Robinhood Taxes Explained 2022 How Are Investment Taxes Handled

Robinhood Crypto Taxes Explained Cryptotrader Tax

How To File Robinhood 1099 Taxes

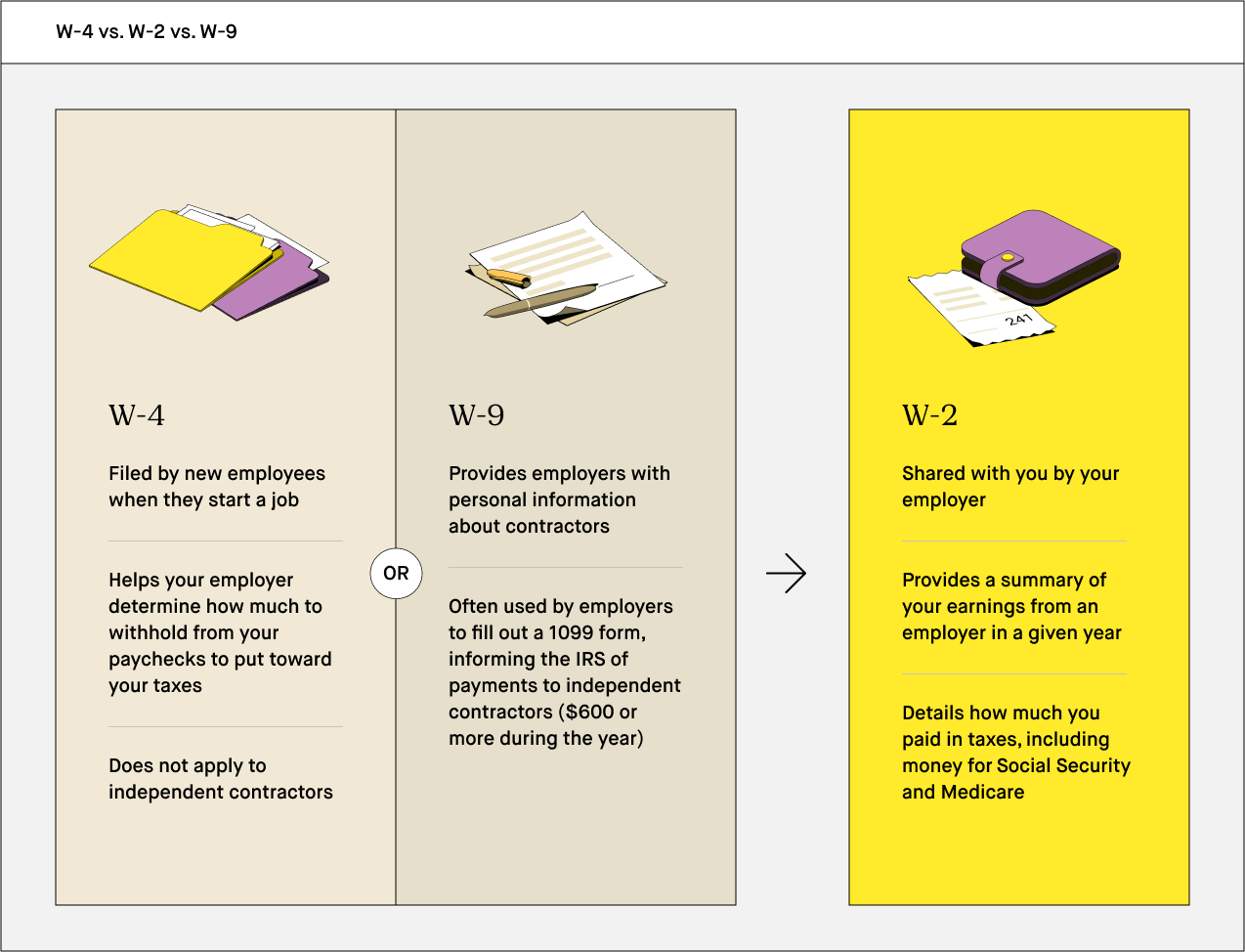

What Is A W 9 Form 2020 Robinhood

Robinhood Crypto Taxes Explained Cryptotrader Tax

United States Not Going To Receive Any Tax Form From Robinhood Where To Report The Dividends Earnings Personal Finance Money Stack Exchange

:max_bytes(150000):strip_icc()/Robinhood-5d409a5aab824a7bb74cf36730fdbe0f.jpg)

Coinbase Vs Robinhood How Do They Compare

How Do Robinhood Crypto Taxes Work Koinly

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube

How Do You Pay Taxes On Robinhood Stocks Benzinga

Sec Sedang Menyelidiki Penanganan Robinhood Atas Perdagangan Gamestop In 2021 Securities And Exchange Commission Blockchain Bitcoin

Cryptocurrency Taxes Guide 2022 How Why To Report Your Profits