When you stake your crypto it simply means you have the opportunity to generate passive income depending on the rewards or interest rates offered by the cryptocurrency. However there is one central difference in how they do this.

What Is Crypto Staking Best Platform To Stake Your Crypto Zipmex

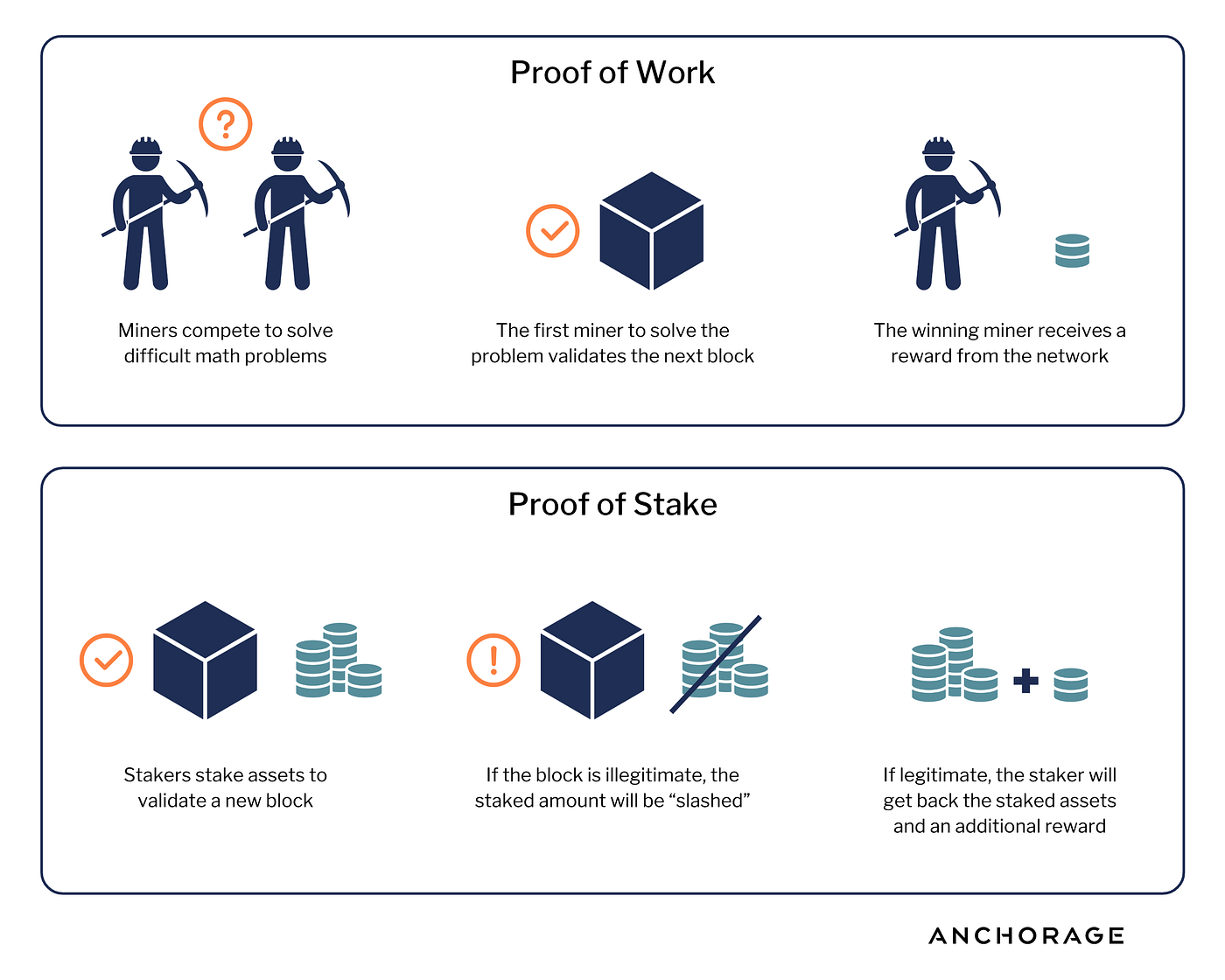

Both are used to verify transactions.

What is staked crypto used for. The Ultimate Guide to Crypto Staking In this ultimate guide to crypto staking well cover everything you need to know about crypto staking. The crypto staking rewards available to you when you stake varies between. The blockchain network uses your crypto for the betterment of the networkfor example conforming transactions in an enhanced way.

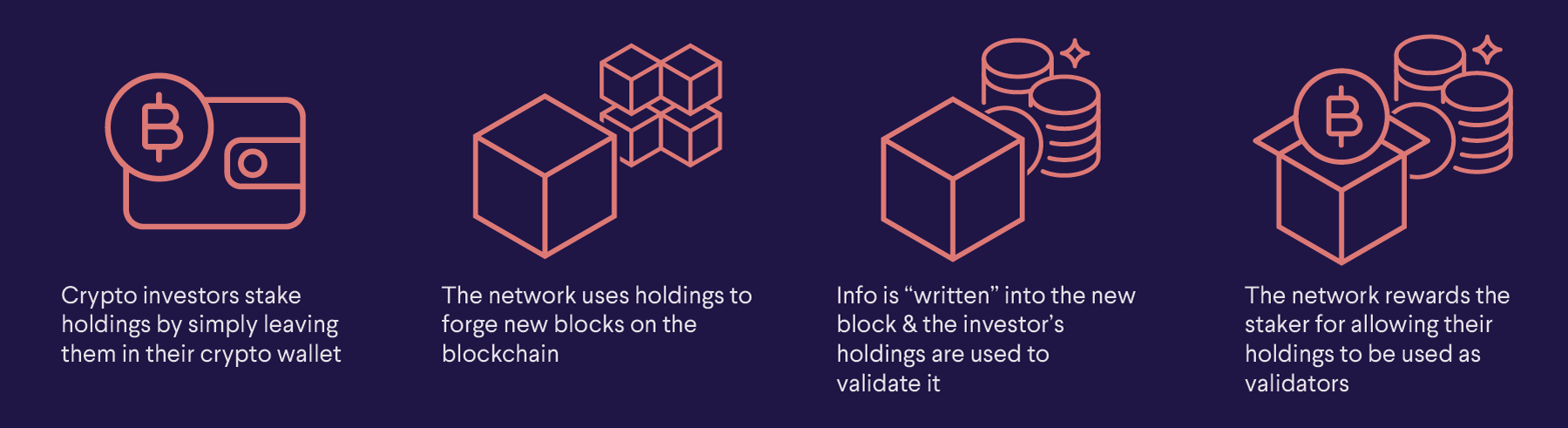

Crypto staking is the lending of cryptocurrencies to be used as collateral by proof-of-stake PoS blockchains to achieve a variety of outcomes such as extending loans validating network transactions earning interest or gaining new crypto tokens yield farming as rewards. Both mechanisms do verify transactions. Staking cryptocurrencies is a process that involves committing your crypto assets to support a blockchain network and confirm transactions.

There are also a number of cryptocurrencies that allow users to stake and earn interest without having to engage in the process of validating blocks. When sending cryptocurrency funds transfers are recorded in open registers. The more coins you stake the higher your chances of being chosen as a validator for the block.

The leading investors in crypto trust Staked to deliver the optimal staking rewards reliably and securely across the broadest range of assets. It was launched with the aim to solve the issues that one of the most popular protocols used for crypto – proof-of-work – started facing. The PoS model is said to be more energy-efficient than Proof-of-Work.

When trading cryptocurrencies it is important to always be aware of your stakes. What Is Proof of Stake and How It Helps You Earn APY. High interest in your crypto stake is given to you in return as a reward.

Whereas with Proof-of-Stake users can stake or lock their crypto assets and at regular. The Staking Partner of Choice for Institutional Crypto. Cardano ADA Minimum delegation requirement is 8 ADA 0 for pool operation though less likely to attract delegators if you have nothing at stake.

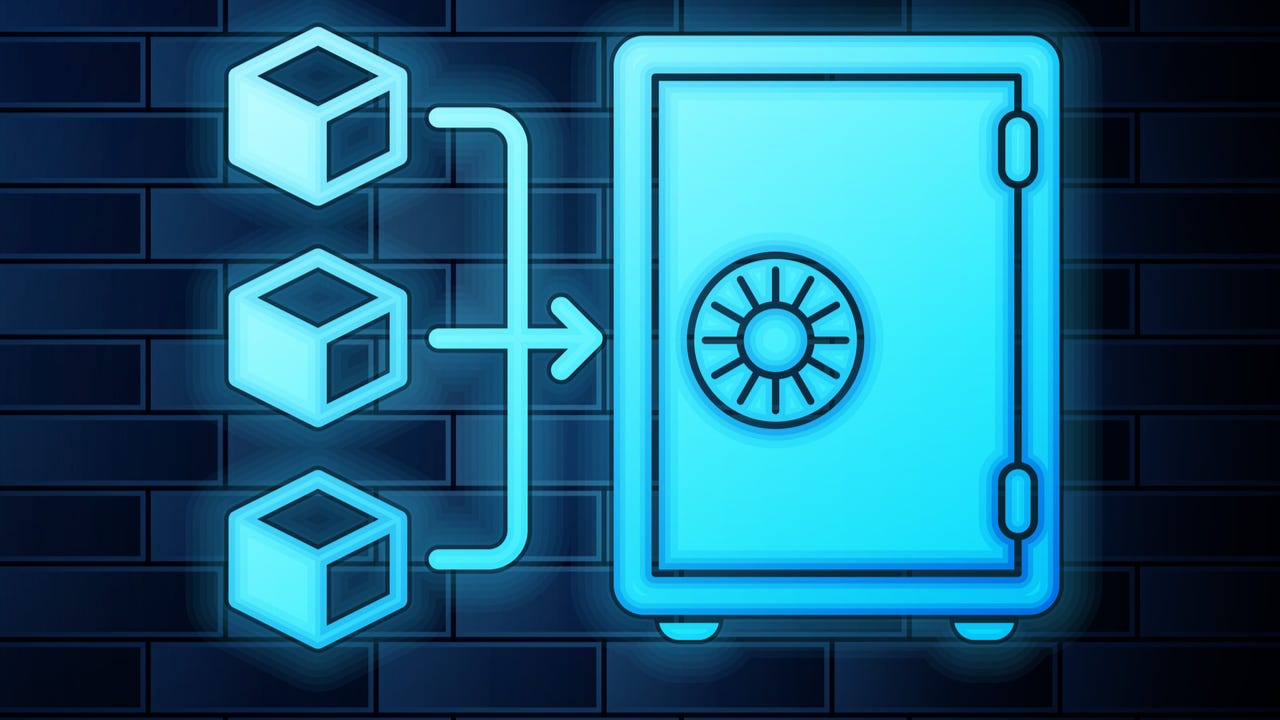

With staking you usually buy a cryptocurrency in order to lock it up stake it in a smart contract. Proof of stake is a type of consensus mechanism or algorithm used to verify cryptocurrency transactions. A user can stake their money on such a network to validate nodes or transactions.

By using this tool you can better understand the amount of risk you are taking on with a particular trade. When users do this they receive rewards. It is a process where a crypto holder donates a portion of their crypto assets for a period of time as a way of helping to maintain a blockchain network.

It is an algorithm. This concept is the idea behind many DeFi decentralized finance projects where users can stake their crypto to earn a fixed interest or yield farming rewards. In simple words staking is the process in which you agree on granting a portion of your crypto to a blockchain network.

In fact it is seen as a paradigm shift that now exchanges are offering crypto staking lately. What is it what are the advantages and risks of staking how to stake is crypto staking legal and more. The new blocks on the chains are validated through staking without having to rely on mining.

In essence it enables holders to monetize their crypto holdings that would otherwise lie idle in their crypto wallet. And the PoW mechanism involves a lot of complex computation. The proof of stake is the concept that facilitates the crypto-staking of coins.

While the process of crypto staking is clear now you might be wondering what the proof-of-stake is. Pool operators can charge. Additionally you can use the calculator to help you determine your potential profits.

Staking is a feature available with the crypto assets that use Proof-of-Stake PoS algorithm to process the payments. It may be helpful to think of crypto staking as similar to putting your cash in a high-yield bank account. Staking via a cryptocurrency exchange means that you make your crypto available via an exchange for use in the proof-of-stake process.

Staking is very similar to mining. A crypto stake calculator is an important tool for all traders. The rewards vary from cryptocurrency to cryptocurrency but they tend to be quite high.

Tezos is also the first proof of stake cryptocurrency that is supported by all major exchanges for staking. While not an exhaustive list here are a few examples of top crypto assets that use proof of stake and their current rewards. These are the best cryptocurrencies to stake in 2021.

SaaS to Streamline and Simplify Active Participation. Staking requires active participation to earn rewards but also has risks. A user can stake funds by locking or holding them in a cryptocurrency wallet.

In this approach the exchange does much of the administrative work for you seeking out a node for you to join so you dont. Tezos can be staked easily using any of the below-mentioned methods. Your crypto if you choose to stake it becomes part of that process.

This method is an alternative to proof of work another consensus mechanism and helps keep blockchains secure by allowing only genuine users to add new trades. Cryptocurrencies that allow staking use a consensus mechanism called Proof of Stake which is the way they ensure that all transactions are verified and secured without a bank or payment processor in the middle. The difference is that mining uses a proof-of-work mechanism to verify transactions while staking uses a proof-of-stake mechanism.

Crypto staking is common with cryptocurrencies that use the proof of stake model to process payments. The wallet should allow the proof-of-stake mining operation to function. Once your stake is locked up you vote to approve transactions in many cases you dont actually have to vote – it happens automatically.

Cryptocurrency was called so due to using encryption to verify transactions it means that advanced coding is employed for storing and transferring coins between digital wallets to ensure the highest level of security. Staking is similar to having your money deposited in the bank because in staking an investor simply locks up their assets in order to earn certain rewards and interests on the assets. The agreement between the staker and the blockchain network is actually pretty simple.

Crypto staking is the process of holding cryptocurrency in a wallet for a period of time and receiving rewards based on how much money is held. Its available with cryptocurrencies that use the proof. Current Proof of Stake Cryptocurrencies.

Locking or holding should usually last for a defined period of time.

What S The Point Of Crypto Staking Learn More Investment U

Crypto Staking How Does It Work Ico Li

What Is Staking Crypto And What Are Its Pros And Cons N26

What Is Staking How Is It Done Here Are The Details Somag News

What Is Staking Crypto 101 Blockchains

Introduction To Crypto Staking Explaining How A Crypto Holder Can Earn By Rishi Sidhu Chorus One Medium

Crypto Staking Guide 2022 Alexandria

Cryptocurrency Staking Explained How To Earn Passive Income While You Hodl Coin Guru

Crypto Staking Guide For Beginners Coolwallet

What Is Staking Frequently Asked Questions About A New Way To Earn Crypto Kraken Blog

What Is Crypto Staking Best Platform To Stake Your Crypto Zipmex

What Is Cryptocurrency Staking How Does Proof Of Stake Pos Work In Blockchain Letsexchange Blog

What Is Staking In Crypto The Motley Fool

How To Increase Crypto Profits With Staking By 3sommas Blog Medium

What Is Crypto Staking And How Does It Work Taxbit Blog

Staking And Inflation Explained For Crypto Investors By Jane Chung Anchorage Digital Medium