Ethereum 20 Staking What is Ethereum 2. Your staked coins are held for a fixed term of 3 6 9 or 12 months in an Ethereum staking wallet that is in synch with a smart contract.

Eth2 0 Staking For Starters Everything You Need To Know About By Mycrypto Mycrypto Medium

Unlike Bitcoin which is more of a digital asset Ethereum is built to be a layer to create decentralized applications.

What is staking ethereum mean. The network reaffirms that the Ethereum 10 alongside its mining system will not be scrapped altogether without its communitys approval. As a validator youll be responsible for storing data processing transactions and adding new blocks to the blockchain. Ethereum staking is the process of holding Ether in a smart contract on the Ethereum blockchain in order to validate transactions add them to the blockchain and return for awards.

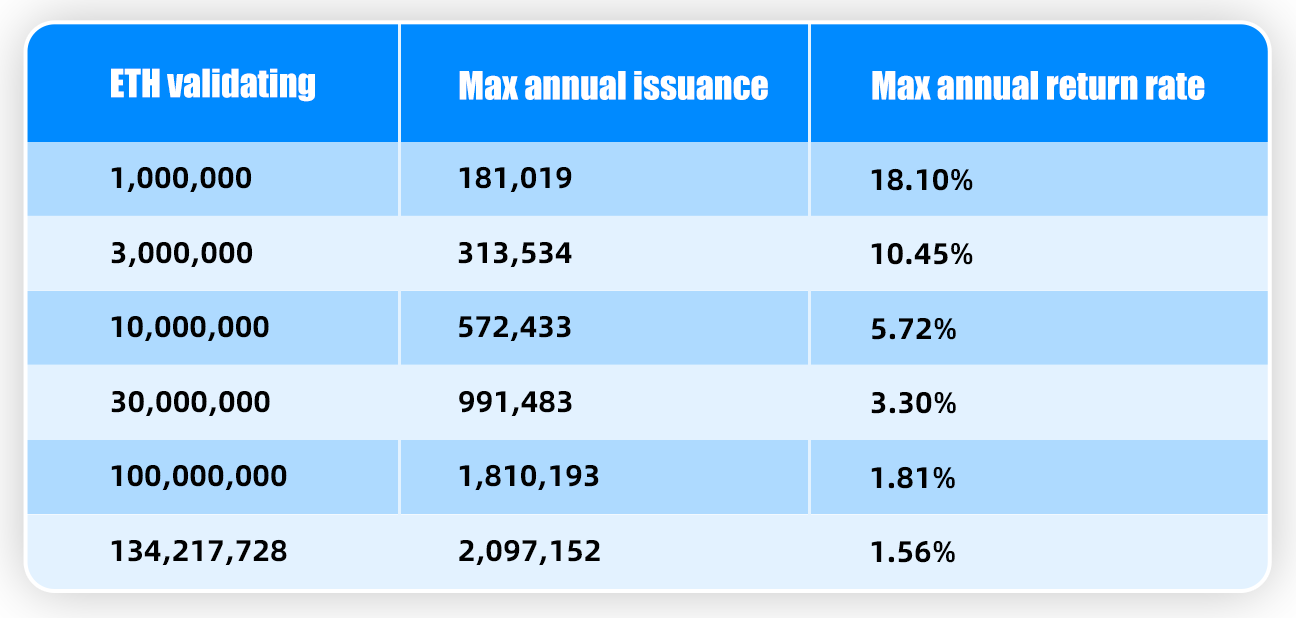

These locked funds help support the security and maintenance of certain blockchains. Validators run a software client that confirms and validates transactions and if they are chosen create new blocks on the blockchain. On these blockchains anyone with the minimum-required balance of 32 ETH can validate transactions and earn Staking rewards.

The strength of the Ethereum staking network is. If youre wondering why you should stake ethereum then take a second to look over these benefits. In summary the risks of staking Ethereum are.

High interest in your crypto stake is given to you in return as a reward. If you are staking Ethereum your ETH is locked until at least the completion of phase 15 meaning you cannot sell transfer or withdraw your ETH. Your ETH stake will continue to generate ETH token rewards but these too are locked.

If a cryptocurrency you own allows staking current options include Tezos Cosmos and now Ethereum via the new ETH2 upgrade you can stake some of your holdings and earn a percentage-rate reward over time. This will keep Ethereum secure for. Put simply Ethereum staking is the process of locking up an amount of ETH the native cryptocurrency of the Ethereum blockchain for a specified period of time in order to contribute to the.

Staking is very similar to mining except that is easier and affordable. Currently Ethereum ETH uses a Proof of Work consensus mechanism. Put simply Ethereum staking is the process of locking up an amount of ETH the native cryptocurrency of the Ethereum blockchain for a specified period of time in order to contribute to the.

The main advantage of staking ethereum is that it helps involve more participants in the network as they can become validators and earn ETH rewards. The concept stems from the fact that you stake your coins and at times you are chosen to validate the next block. Staking means crypto holders can lock up their coins in a cryptocurrency wallet to engage in the validation of transactions on a blockchain to also receive rewards in return.

Staking is the process of holding or locking cryptocurrencies in a target wallet for a specified period of time in exchange for rewards and crypto passive income. Ethereum 2 ETH2 is an upgrade to the Ethereum network that aims to improve the networks security and scalability. Staking is the act of depositing 32 ETH to activate validator software.

That being said even after staking is officially introduced into the Ethereum network it does not necessarily mean that it will completely replace the current mining system. These software clients are so lightweight that they can in theory even run on a smartphone. This usually happens via a staking pool which you can think of as being similar to an interest-bearing savings account.

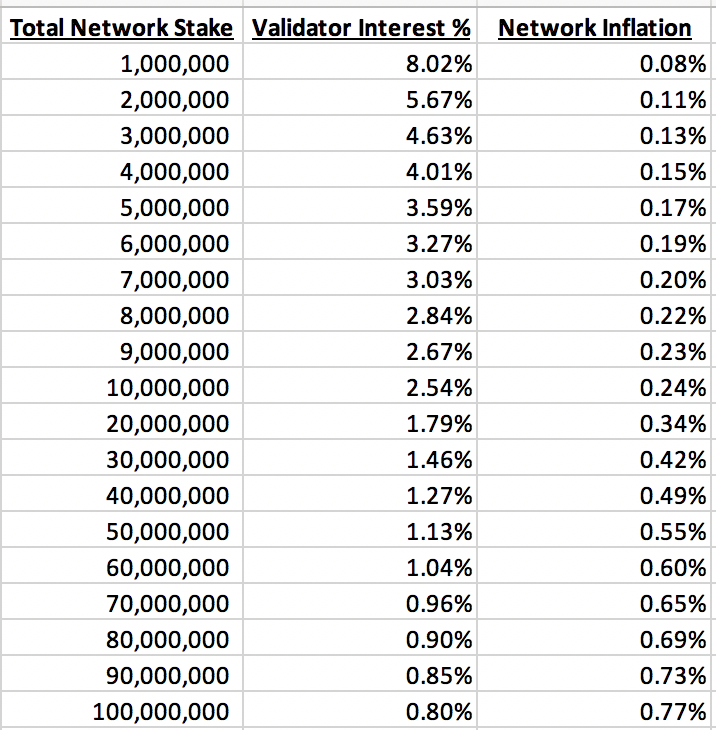

Its not uncommon for cryptocurrencies to have a lock-in period. The amount of reward you will collect depends on the elapsed time the longer you hold your coins in a staking wallet the greater the reward will be. Staking is one of the best ways to make a passive income with cryptocurrency.

To stake you put aside part of your holdings of the blockchains native coin your ether for Ethereum s blockchain for example and the amount you stake gives you a probability of being assigned the task. Staking meany you are actively participating in transaction validation similar to mining but on a proof-of-stake PoS blockchain. When that happens it will allow Ethereum investors to stake their ETH and earn a passive income.

It is important to note that there are many coins that use proof of stake such as Tezos Cosmos and Cardano and each coin has different rules as to how it calculates and distributes rewardsIn this post we will focus mainly on how Ethereums proof of stake model works. If you want to run your own staking node youll need 32 Ethereum. For staking you deposit 32 ETH to become validator.

Earning passive income Become a validator and help keep the decentralization of the network. In simple words staking is the process in which you agree on granting a portion of your crypto to a blockchain network. However Ethereum plans to transition to Proof of Stake.

With Ethereum 20 being executed on a multi-year roadmap one of the biggest concerns with becoming a validator is the potential illiquidity during Phases 0-2. The more coin you lock the greater will be the chance of you being chosen for the reward. What is Staking Ethereum.

The blockchain network uses your crypto for the betterment of the networkfor example conforming transactions in an enhanced way. It is a process comparable to Bitcoin mining but much less resource-intensiveWhile Bitcoin relies on Proof of Work PoW. Proof of stake introduces scalability to.

What is staking. This upgrade involves a shift in Ethereums mining model Proof-of. Up until 2020 Ethereums blockchain was based purely on proof of work.

But does that mean that the price of ETH should increase with it. This tokenized ETH is basically a sort of IOU you stake your ETH on Ethereum 20 in a special staking pool and a custom Ethereum application created by the staking pool provider will mint create an ERC-20 version of the ETH you have staked in the 20 pool. ETH 2 Staking Risks Liquidity Issues.

The more you stake the higher the chances youll be doing the task processing transactions validating information and more. Staking means that one is devoting an amount of ether to become a validator on the network. In staking you hold and lock an amount of your coin and validate transactions.

Your Ethereum is inaccessible until the upgrade rolls out If cryptocurrencies became regulated the outcome is uncertain All cryptocurrencies are unchartered territory so future price predictions have no real quantitive substance Potential slashing unlikely but it still has to be mentioned.

3 Aspects Of Ethereum 2 0 Staking To Consider Before Committing 32 Eth Cryptomode

Ethereum 2 0 Staking Eth On Eth2 Figment Building Web 3

Apa Itu Staking Binance Academy

Understanding Ethereum Staking Deposits

Ethereum 2 0 Staking A Beginner S Guide On How To Stake Eth

Cybavo A Guide To Ethereum 2 0 Staking With Cybavo

Ethereum 2 0 Eth Staking How It Works

The Economic Incentives Of Staking In Serenity Economics Ethereum Research

Ethereum Staking Explained How You Can Earn Passive Income

Staking Ethereum Vs Mining Bitcoin Mdash Which Is More Profitable

Ethereum 2 0 Staking Eth On Eth2 Figment Building Web 3

How To Stake 32 Eth The Best Practices Eth2 Staking By Gaurav Agrawal Coinmonks Medium

How To Earn Interest With Staking Ethereum Eth Bitcoin Ira

Eth 2 0 Staking For Everyone Starting With As Low As 0 1 Eth By Tokenpocket Medium

Ethereum 2 0 Eth Staking How It Works

Ethereum Staking Explained Hilamia By Juven Ltd

Ethereum Staking Explained How You Can Earn Passive Income

Ethereum Eth Staking Definitive Guide For 2022 Haru

Eth 2 0 Staking For Everyone Starting With As Low As 0 1 Eth By Tokenpocket Medium